Description

Introduction to Deriv: A Comprehensive Broker Review

In this thorough review, we’ll explore Deriv, an online trading platform that has carved out a prominent place in the world of financial markets. We’ll dive deep into its offerings, highlight its advantages and disadvantages, and provide an overview of the trading conditions, customer support, and overall user experience. Whether you’re a seasoned trader or a beginner, this review will help you determine if Deriv is the right broker for you.

About Deriv

Deriv is a well-established online trading broker that provides access to a diverse range of financial instruments, including forex, commodities, cryptocurrencies, and synthetic indices. With over two decades of industry experience, Deriv has become a leading player in the forex market. The broker is known for its innovative services, especially through its proprietary trading platforms like Deriv X and Deriv Go, which are designed to cater to traders of all experience levels.

Is Deriv a Trustworthy Broker?

Absolutely, Deriv is a reputable and regulated broker that has garnered trust across the trading community. It operates under the scrutiny of multiple financial regulatory bodies, ensuring it meets stringent operational standards that safeguard its clients. Specifically, Deriv is regulated by the Malta Financial Services Authority (MFSA), the Labuan Financial Services Authority (LFSA) in Malaysia, the British Virgin Islands Financial Services Commission (BVI FSC), and the Vanuatu Financial Services Commission (VFSC). These regulations are a strong indicator of Deriv’s commitment to providing a secure and transparent trading environment, reducing the risk of fraudulent activities.

Where is Deriv Broker Located?

Deriv is a global broker with a significant presence across various regions. The company’s headquarters, Deriv (SVG) LLC, is situated at Hinds Buildings, Kingstown, St. Vincent and the Grenadines. In addition to its main office, Deriv has expanded its operations to several key locations around the world, including Dubai (UAE), Malta, Cyprus, Malaysia (with three offices), France, the Channel Islands, Paraguay, Rwanda, and Belarus. This global footprint not only enhances Deriv’s accessibility but also reflects its commitment to serving clients in diverse markets.

Deriv Account Types

Deriv offers a variety of account types designed to cater to different trading needs and preferences. Here’s a closer look at the main account options:

- Derived Account (Formerly Synthetic Indices Account): This account type is tailored for traders who focus on synthetic indices, which are uniquely available on Deriv. These indices simulate real-world market conditions, offering opportunities for trading even when traditional markets are closed.

- Financial Account: This is the standard account for trading forex, commodities, stocks, and other financial instruments. It’s designed for traders who want to engage in a broad range of markets.

- Swap-Free Account: This account adheres to Islamic finance principles by eliminating swap fees on overnight positions. It’s particularly suitable for traders who wish to trade without earning or paying interest.

In addition to these, Deriv also offers specialized accounts:

- cTrader Account: Ideal for those who prefer the cTrader platform, known for its advanced trading features and user-friendly interface.

- Deriv X Account: Tailored for users of the Deriv X platform, this account type offers access to the unique tools and functionalities of Deriv’s proprietary trading platform.

All Deriv accounts come with a demo option, allowing traders to practice and refine their strategies using virtual funds. Furthermore, each account is independently audited to ensure fairness and transparency. The minimum deposit requirement across all accounts is a modest $5, making it accessible for traders at all levels.

Deriv Derived Account

The Deriv Derived account is specifically designed for trading synthetic indices, such as Boom and Crash, Volatility Indices, and Jump Indices, which are exclusive to Deriv. Synthetic indices mimic the behavior of real-world markets but are immune to external influences like news events, economic data releases, and other real-world factors. This unique feature allows traders to engage in market speculation without the unpredictability that comes from global events. The Derived account offers 24/7 trading, even during holidays, giving traders the flexibility to manage their positions at any time. Additionally, the account provides multiple volatility levels to choose from, offering a tailored trading experience that aligns with various risk preferences.

Deriv Financial Account

The Deriv Financial account, previously known as the Deriv Standard account, is ideal for traders looking to access a broad range of financial instruments. This account allows CFD trading on over 170+ assets, including major and minor forex pairs, stocks, stock indices, commodities, cryptocurrencies, and ETFs. With leverage of up to 1:1500, traders have the potential to significantly amplify their positions. The account is structured with Straight-Through-Processing (STP) execution, ensuring tight spreads and competitive pricing. This setup is particularly appealing to traders who seek efficient market access and minimal slippage.

Deriv Swap-Free Account

The Deriv Swap-Free account caters to traders who wish to avoid overnight interest fees, making it compliant with Islamic finance principles. This account is suitable for both Islamic traders and those who prefer not to incur swap charges on positions held overnight. The swap-free option is available across all of Deriv’s trading platforms, including DTrader, SmartTrader, and DMT5. While the spreads and commissions on swap-free accounts are typically slightly higher than those on standard accounts, this adjustment compensates for the broker’s provision of swap-free trading. This account type allows traders to access a wide range of markets, including forex, indices, commodities, and cryptocurrencies, without the added cost of overnight fees.

How to Open a Deriv Live Account

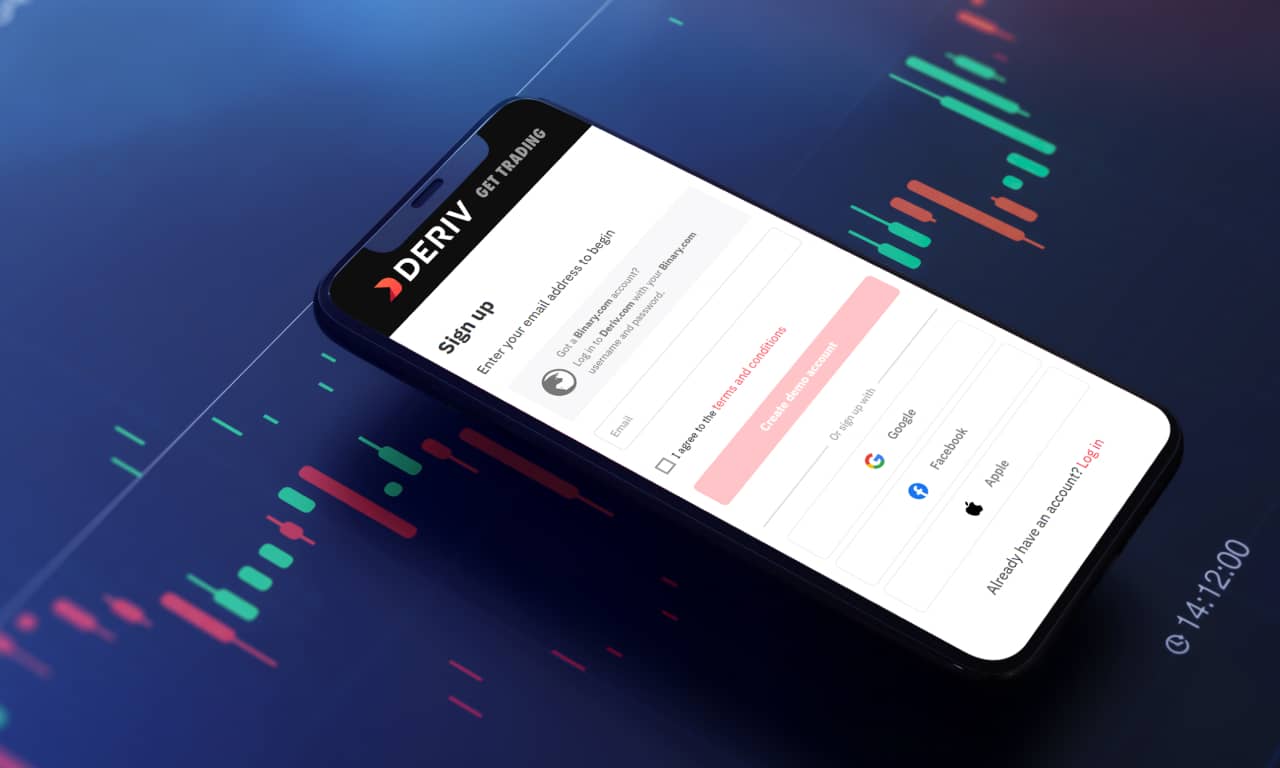

Opening a live trading account with Deriv is a simple and user-friendly process. Just follow these steps:

- Access the Deriv Sign-Up Page: Start by visiting the Deriv live account registration page. You’ll be greeted with a user-friendly interface similar to the one shown below.

- Enter Your Email and Accept the Terms: Provide your email address and agree to the terms and conditions. Click on the ‘Create demo account’ button to proceed.

- Verify Your Email Address: Check your inbox for a verification email from Deriv. Once confirmed, continue by entering your personal information on the subsequent screens.

- Explore the Demo Account: After email verification, you’ll automatically be logged into a Deriv demo account with $10,000 in virtual funds. This allows you to familiarize yourself with the platform before moving on to a live account.

- Upgrade to a Real Account: To open a live account, click on the (1) “Trader’s Hub” option located at the top left of your dashboard. Then, navigate to (2) ‘Real’ > (3) ‘CFD’s’. Choose the Deriv account type you wish to open from the available options. Click ‘Get’ and select the appropriate jurisdiction for your Deriv MT5 Derived account.

Trading Assets Offered by Deriv

Deriv provides a diverse range of over 100 trading instruments across various asset classes. Here’s a breakdown of what you can trade with Deriv:

|

Asset Class |

Details |

|

Forex |

Nearly 50 currency pairs, including major, minor, and exotic pairs, allowing you to trade in global currency markets. |

|

Stock Indices |

Speculate on the price movements of major US, Asian, and European stock indices, covering the largest global markets. |

|

Synthetic Indices |

Unique to Deriv, these indices mimic real-world market conditions with consistent volatility, available 24/7. They are based on a secure random generator and are unaffected by real-world events. |

|

Commodities |

Trade in precious metals like gold and silver, as well as energy commodities such as oil. |

|

Cryptocurrencies |

Access a range of popular cryptocurrencies, allowing you to trade digital assets with ease. |

Deriv’s wide selection of trading assets offers flexibility and opportunities for traders to diversify their portfolios across various markets. Whether you’re interested in traditional assets like forex and commodities or unique products like synthetic indices, Deriv has something to suit your trading needs.

Deriv Deposit & Withdrawal Methods

Deriv provides a wide range of deposit and withdrawal methods, ensuring convenience and flexibility for its clients. Here’s a comprehensive list of the available options:

|

Payment Method |

Description |

|

💳 Credit & Debit Cards |

Use major credit and debit cards for quick and secure transactions. |

|

💳 Perfect Money |

A popular e-wallet option for easy deposits and withdrawals. |

|

💳 Payment Agents & Dp2p |

Utilize local payment agents and Deriv’s peer-to-peer service (Dp2p) for localized payment solutions. |

|

💳 WebMoney |

Another widely-used e-wallet that supports efficient fund transfers. |

|

💳 Cryptocurrencies |

Deposit and withdraw using Bitcoin, Ethereum, Litecoin, and Tether for decentralized transactions. |

|

💳 Paysafe |

Secure online payment option through prepaid vouchers. |

|

💳 Zingpay |

A convenient payment solution supporting seamless transactions. |

|

💳 Jeton |

Use Jeton wallet for smooth and hassle-free deposits and withdrawals. |

|

💳 Fasapay |

A reliable e-wallet for transferring funds swiftly. |

|

💳 Bank Wire Transfer |

Traditional bank transfers for high-value deposits and withdrawals, ideal for large transactions. |

Deriv ensures that its clients have access to a broad array of payment methods, catering to various preferences and making it easier for traders to manage their funds. Whether you prefer traditional banking methods or modern digital wallets, Deriv provides a solution that suits your needs.

Deriv Minimum Deposit

Deriv offers flexible deposit options with a low minimum deposit requirement, making it accessible for traders of all levels. The minimum deposit varies depending on the payment method:

|

Deposit Method |

Minimum Deposit |

Processing Time |

Details |

|

E-wallets (AirTM, WebMoney, etc.) |

$5 |

Instant |

Low minimum deposit requirement, available for popular e-wallets like AirTM, WebMoney, PerfectMoney, Neteller, and Skrill. |

|

Credit/Debit Cards |

$10 USD/GBP/EUR/AUD |

Instant |

Accepts Visa and Mastercard, with quick and secure processing. |

|

Bank Wire Transfer |

$10 |

Typically Instant |

Traditional bank transfer option with a reasonable minimum deposit amount. |

|

Cryptocurrencies |

No Minimum Deposit |

3 Blockchain Confirmations |

Supports Bitcoin, Ethereum, Litecoin, and Tether with no minimum deposit requirement. |

|

Payment Agents |

10 of your base currency |

Varies by agent |

Use local payment agents for deposits in your base currency. |

|

Deriv Peer to Peer (Dp2p) |

1 of your base currency |

Varies |

A low minimum deposit option through Deriv’s peer-to-peer service. |

Deposit and Withdrawal Currencies Accepted by Deriv:

Deriv allows deposits and withdrawals in the following currencies:

- EUR

- USD

- GBP

- AUD

Please note that you can only select one of these currencies as your base currency when opening your account. Once the base currency is set, it cannot be changed after making your initial deposit.

Deriv’s approach to deposit flexibility, along with the absence of deposit fees, reduces overall trading costs and makes it an attractive choice for traders worldwide.

Deriv Minimum Withdrawal

The minimum withdrawal amount at Deriv varies based on the withdrawal method you choose:

|

Withdrawal Method |

Minimum Withdrawal |

|

E-Wallets |

$5 of your base currency |

|

Credit Cards |

$10 of your base currency |

|

Payment Agents |

$10 of your base currency |

|

Deriv Peer-to-Peer (Dp2p) |

$1 |

|

Cryptocurrencies |

Bitcoin: 0.0026 BTC (lowest) |

Deriv Fees & Spreads

Deriv is known for offering highly competitive trading conditions. Here’s a breakdown of the fees and spreads:

|

Trading Aspect |

Details |

|

Forex Spreads |

Spreads on major pairs like EUR/USD start from as low as 0.5 pips, which is below the industry average. |

|

Other Asset Spreads |

Competitive spreads are also available on stocks, indices, cryptocurrencies, and commodities. |

|

Commission |

Deriv offers commission-free trading across its range of assets, enhancing cost-effectiveness. |

|

Deposit & Withdrawal Fees |

There are no fees charged for deposits or withdrawals, keeping costs low for traders. |

|

Overnight Fees |

Positions held overnight are subject to swap fees, except for those using a swap-free account. |

|

Inactivity Fee |

A $25 fee is charged on accounts that remain inactive for over 12 months. |

Deriv’s commitment to offering tight spreads and zero commission trading makes it an attractive choice for traders across various markets. The absence of deposit and withdrawal fees further enhances its appeal, allowing traders to maximize their returns without worrying about hidden costs.

Deriv Trading Platforms

Deriv impresses with its diverse range of proprietary trading platforms, offering unique tools and features tailored for traders of all levels. Let’s explore these platforms and their standout features.

|

Platform |

Key Features |

Availability |

|

DMT5 |

Deriv’s version of MetaTrader 5 offers advanced charting, technical indicators, and customizable order types. Available as a desktop app, mobile app, and WebTrader. |

Desktop, Android, iOS, Web |

|

DTrader |

A user-friendly web-based platform with easy-to-use features, quick order execution, and customizable charts. Suitable for both novice and experienced traders. |

Web |

|

Deriv X |

A highly customizable CFD trading platform with over 90 indicators, 13 drawing tools, and drag-and-drop widgets. Trade multiple assets across markets simultaneously. |

Desktop, Android, iOS |

|

DBot |

A platform to build and automate trading bots without coding experience. Offers pre-built strategies and backtesting capabilities for synthetic indices trading. |

Desktop |

|

Deriv GO |

A mobile trading app for trading forex, synthetic indices, commodities, and cryptocurrencies. Features include risk management tools like stop loss and take profit. |

Android, iOS |

|

Deriv EZ |

A straightforward CFD trading platform with instant access to over 150 assets in various markets. No additional account ID or password required. |

Web |

|

Deriv Copy Trading (cTrader) |

Automatically copy trades of experienced strategy providers. Ideal for beginners and a great income source for seasoned traders. |

cTrader (Desktop, Web, Mobile) |

DMT5 (Deriv MetaTrader 5)

DMT5 is Deriv’s customized version of the MetaTrader 5 platform, renowned for its robust charting tools, extensive technical indicators, and diverse order types. It’s accessible on desktop, mobile (both Android and iOS), and as a WebTrader with slightly limited features. The platform caters to both beginner and advanced traders.

DTrader

DTrader is a web-based trading platform offering a simplified interface perfect for quick and efficient trading. It provides basic charting tools, a variety of trade types (such as Up/Down and Touch/No Touch), and allows you to trade multipliers. This platform is ideal for traders looking for a straightforward trading experience.

Deriv X

Deriv X is a fully customizable CFD trading platform, enabling you to trade across multiple markets with ease. It’s packed with over 90 indicators, 13 drawing tools, and features that let you personalize your trading environment. Deriv X supports both desktop and mobile (Android and iOS), making it a versatile choice for traders.

DBot

DBot is Deriv’s platform for creating automated trading robots without needing any coding knowledge. Users can build bots by dragging and dropping pre-built blocks onto a canvas. DBot is designed for those who want to automate their trading strategy, especially in synthetic indices. It also offers backtesting and deployment of strategies in the live market.

Deriv GO

Deriv GO is a mobile app designed for traders on the move. It supports trading in forex, synthetic indices, commodities, and cryptocurrencies. The app includes risk management tools such as stop loss, take profit, and deal cancellation, ensuring that traders can manage their trades effectively. Available on Android and iOS, Deriv GO offers a seamless trading experience with competitive fees and spreads.

Deriv EZ

Deriv EZ provides a simple and straightforward trading environment with instant access to over 150 assets, including forex, stocks, indices, commodities, and derived indices. This platform is ideal for traders who prefer a no-frills approach with all necessary tools at their fingertips.

Deriv Copy Trading (via cTrader)

Deriv’s copy trading feature allows you to replicate the trades of seasoned strategy providers automatically. It’s a perfect platform for beginners to learn and for experienced traders to monetize their strategies. Available through Deriv cTrader, this platform offers an intuitive interface for copying trades efficiently.

Deriv Trade Types

Deriv Forex Broker offers three distinct trade types, each designed to cater to different trading strategies and risk appetites.

1. CFD Trading on Deriv Broker

CFD (Contract for Difference) trading allows you to speculate on the price movement of an asset without actually owning the asset. On Deriv, you can trade CFDs with high leverage and tight spreads, making it possible to maximize your trading potential. You can trade on a wide range of financial markets, including forex, commodities, stocks, and indices, as well as Deriv’s unique synthetic indices, which are available 24/7. This type of trading is ideal for traders looking to capitalize on short-term market movements.

2. Multipliers Trading on Deriv Forex Broker

Deriv’s multipliers trading combines the advantages of leverage trading with the safety of options trading. This means you can amplify your potential profits when the market moves in your favor, while your losses are limited to your initial stake if the market moves against you. This trade type is especially suitable for traders who want to enhance their returns with a controlled risk environment.

3. Options Trading on Deriv

Options trading on Deriv allows traders to predict market movements without needing to own the underlying asset. By opening a position that predicts whether an asset will move up or down over a specified period, traders can potentially earn payouts based on their predictions. This form of trading is accessible with a minimal capital investment, as low as 35 cents per contract, making it an attractive option for those new to the financial markets.

Deriv Sign-up Bonus

Deriv Broker does not currently offer a sign-up bonus, deposit bonus, or welcome bonus. While some brokers use bonuses to attract new traders, Deriv focuses on providing excellent trading conditions without the need for promotional incentives. The absence of bonuses should not deter traders, as Deriv’s competitive spreads, high leverage, and innovative trading platforms offer substantial value on their own.

Deriv Customer Support

In our assessment of Deriv, we discovered that the broker provides round-the-clock customer support available 24/7. Traders can reach out to the support team via multiple channels, including Live Chat, WhatsApp, and the Help Center. Additionally, Deriv’s customer service is offered in eleven different languages, ensuring that traders from various regions can receive assistance in their preferred language.

Deriv Education

Our review of Deriv revealed that the broker offers access to the Deriv Academy, a resource hub where traders can find the latest market news, educational videos, and informative trading articles. However, it is worth noting that Deriv does not currently offer more interactive learning options such as trading seminars, webinars, or in-depth market insights and research materials. Despite this, the resources provided in the Deriv Academy can still serve as a valuable starting point for traders looking to enhance their knowledge.

Deriv Broker Review: My Final Thoughts

In summary, my experience with Deriv has shown that it is a dependable broker offering a broad array of trading instruments and sophisticated trading platforms. The broker is licensed and regulated by multiple reputable financial authorities, ensuring a high standard of security and transparency for its clients.

Deriv’s commission-free trading model, along with the absence of deposit and withdrawal fees, makes it an affordable choice for traders, particularly with its low trading costs. Additionally, the low minimum deposit requirement and the availability of a demo account make Deriv accessible to traders of all experience levels.

Overall, I am impressed with Deriv’s trading environment and the variety of products it offers. For those in search of a trustworthy and secure broker, Deriv stands out as an excellent choice.