Best CFD Brokers 2022

Why you should find the best CFD brokers

Finding which are the best CFD brokers in 2022? This article contains all of the information that will help guide the decision-making process.

It’s possible to refer to CFDs as financial instruments that are critical to a trader’s portfolio. But, how does the whole system work? Basically, experts calculate profit and losses by comparing the differences in price that exist between when traders enter and exit a contract.

Essentially, brokers will pay these differences depending on whether or not traders make a profit. If it’s a loss, the trader has to pay the broker the difference in prices.

For beginners to CFD trading, this can all seem like a complicated process. However, the choice of a CFD broker can make trading a seamless process. This is a choice traders will find easier after reading this comprehensive guide. Keep reading to find out the best CFD brokers in 2022.

Best CFD Brokers in 2022 Details

Take a look at our list of the best CFD Brokers.

1. Capital.com

When you use Capital.com, you can trade CFDs on the NASDAQ 100, gold, oil, Tesla and about 6500 other assets or markets. When Capital.com, you get:

- Tight spreads

- No commissions

- Fast order execution

- High privacy and security standards

- Educational tools

- Current news items

As you look into investing in CFDs, you can do more than throwing your money into the markets and waiting for a result. You can make informed decisions and grow your portfolio naturally.

The firm is regulated by:

- Financial Conduct Authority

- The Australian Securities and Investments Commission

- The Cyprus Securities and Exchange Commission

- National Bank of the Republic of Belarus

With an easy-to-use interface and intuitive, AI-powered platform, you benefit from Capital.com learning about your trading habits and informing you of best practices that can help you grow your portfolio.

- Zero commissions on CFDs, spread bets and shares

- Low bid/ask spreads

- 24/7 customer service

- Intuitive mobile app available at Google Play and Apple App Stores

- Not available for United States residents

- High-risk investments for retail traders

- No leverage or fractional shares available in stockbroking accounts

2. eToro – Top-Rated CFD Broker With Copy Trading Tools

eToro is a popular online broker that offers both ‘real’ assets and CFD instruments. Regarding the former, it is possible to invest in stocks and ETFs at 0% commission, from a minimum of $10 per trade. It is also possible to invest in cryptocurrency, with more than 90+ coins supported at a fee of just 1% per slide.

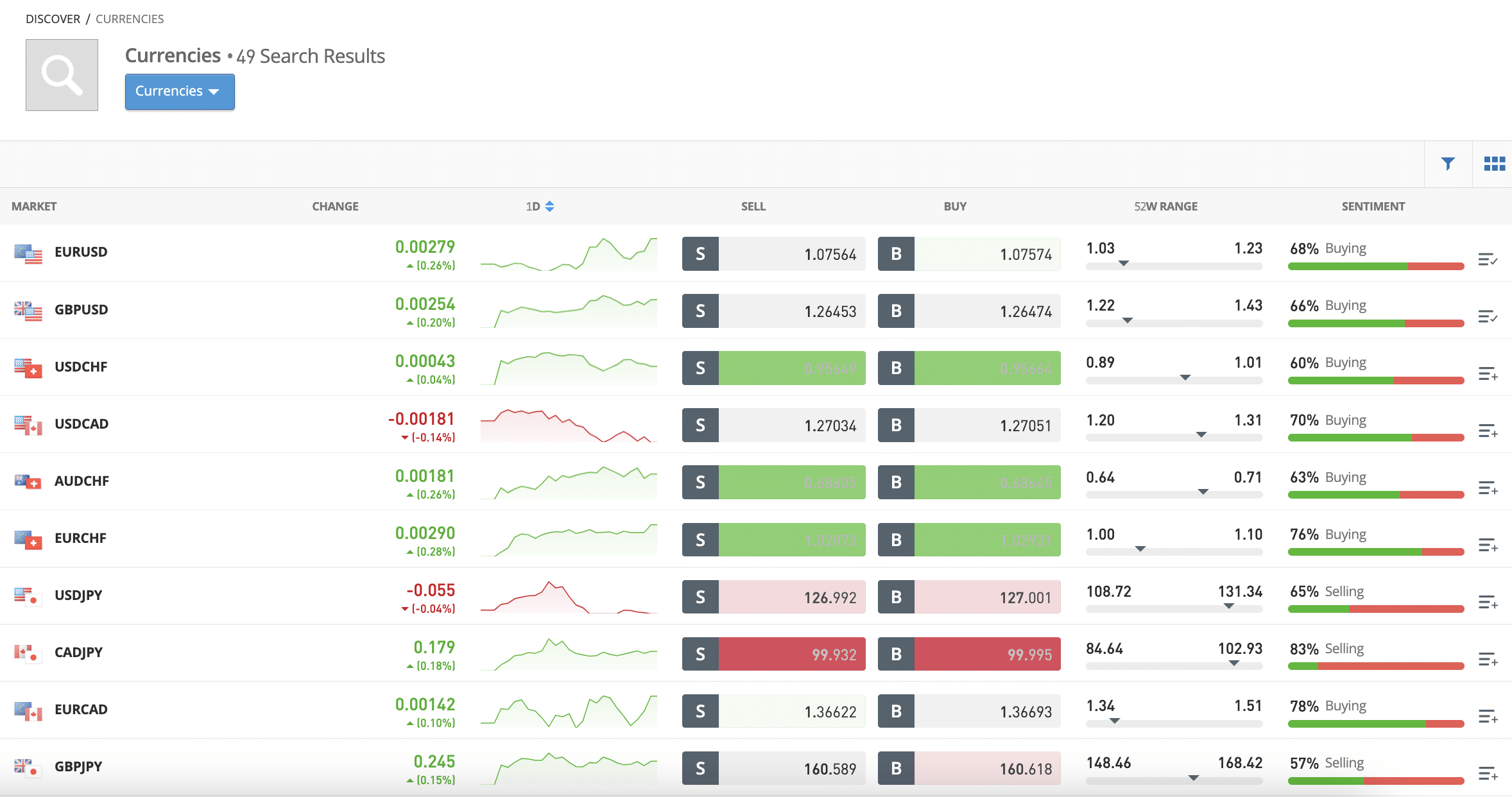

Those wishing to trade leveraged CFDs can do so across more than 3,000 instruments. This includes commodities, indices, stocks, ETFs, forex, and more. All CFD markets at eToro can be traded on a spread-only basis. To offer some insight into potential charges, spreads on forex start at 1 pip. eToro offers spreads of 5 pips on oil and silver, and 45 pips on gold.

Indices such as the S&P 500 are particularly competitive, with the S&P 500 offering a spread of just 0.75 points. eToro is very transparent with the fees it charges, especially when it comes to overnight funding on leveraged positions. This is because the broker displays the daily and weekend leverage fee in dollars and cents when setting up an order.

eToro also enables traders to deposit and withdraw funds for free when USD is the primary currency being used. Other currencies are supported too but these will attract an FX charge of 0.5%. When it comes to trading tools, eToro is very feature-rich. First, it offers a passive investment tool called Copy Trading.

This offers access to thousands of verified traders that use the eToro platform professionally. eToro users can choose a suitable trader to copy and then all future investments will automatically be copied over to the account portfolio. This popular feature does not attract any additional fees and the minimum per-trader investment requirement is just $200.

Another popular feature at eToro is its Smart Portfolios. These are professionally managed by the eToro brokerage platform and each Smart Portfolio tracks a certain marketplace. For instance, there are Smart Portfolios can offer exposure to stocks from the renewable energy, Big Tech, or driverless car niches. No additional management fees are charged on this feature.

| Best for Copy Trading | Overall Rating ⭐️⭐️⭐️⭐️ |

[button size=”medium” style=”primary” text=”Visit Etoro” link=”https://www.etoro.com/” target=”Etoro”] | |

| Founded in 2007, eToro has more than 25 million users in 140 countries worldwide — and the U.S. is now on that list. In 2022, the company began offering U.S. customers access to stocks and ETFs. Previously, while eToro ran multi-asset brokerages (offering stocks, commodities and forex trading) in other countries, U.S. customers could trade only cryptocurrencies on the platform. | |||

Pros

-

Social investing: Ability to match moves of popular traders.

-

Advanced trading features in mobile app.

Cons

-

Service not available in all states.

-

No crypto-to-crypto trading pairs.

3. FOREX.com

The highly regulated firm FOREX.com offers 220 CFDs across major asset classes through its FOREX.com brand. That information, plus a quick test-drive of FOREX.com’s platforms means it’s all you need to confirm that you’re in good hands. Exceptional platform speed and performance drives the FOREX.com experience, and you’ll get CFD trading on stocks, commodities and indexes.

No matter what you trade, you’ll gain access to FOREX.com’s Advanced Trading Platform, the renowned MetaTrader 4 platform as well as a web-based platform and mobile trading option. All accessibility options ensure that you won’t miss a thing.

To fund your account, the minimum initial deposit required is at least 50 of your selected base currency. However, FOREX.com recommends you deposit at least 2,500 to allow you more flexibility and better risk management when trading your account.

Forex markets are open 24 hours a day, Sunday to Friday. FOREX.com makes itself available 24/5 during open market hours. Note that FOREX.com only offers CFDs only in FCA and CIMa regulated regions.

Pros

- Wide range of product offerings

- TradingView charts built into web platform

- Regulated by FCA (U.K.) & CFTC, NFA (U.S.)

- Offers protection for U.K./E.U. client accounts

- Rebates for high-volume traders

Cons

- No account protection for U.S. clients

- No guaranteed stop losses for U.S. clients

- Subpar website maintenance

4. CMC Markets

CMC Markets provides access to trade over 11,500 global instruments with competitive spreads and rates. Trading leverage varies from 30:1 for forex pairs to 2:1 for cryptocurrencies.

- Forex: Trade over 330 different currency pairs with dealing spreads starting at 0.07 pips. Margin rates for forex are the lowest at 3.3%. CMC combines eight feeds from tier-one banks to obtain the best exchange rates for your trading. You can get fully automated executions in as little as 0.0045 seconds on most forex trades with minimal slippage.

- Indices: Trade over 80 indices can be traded with a minimum spread of 0.3 points with 6.667:1 leverage. No dealer intervention regardless of your trading size means no partial fills, and you can trade 24 hours a day 5 days a week.

- Cryptocurrencies: Trade up to 14 crypto CFDs with a minimum spread of 3.8 points and leverage of 2:1. CMC guarantees a 99.9% fill rate with fully automated lightning-fast executions. Also, if you’re in Canada or the U.K., you pay no capital gains tax on profits from cryptocurrency spread bets.

-

Commodities: Trade over 100 cash and forward commodities with spreads as low as 0.3 points with 20:1 leverage. Some commodities trade up to 23 hours a day, and you trade “cash” markets with tighter spreads and no rollovers.

- Shares: Over 9,000 U.S. and Canadian listed shares CFDs are available to trade with a minimum spread of just 0.10% or 0.02 per share on many U.S. and Canadian shares with 5:1 leverage.

- Treasuries: Trade CFDs on more than 50 global interest rate and government debt instruments with 5:1 leverage. You get fully automated, fast executions with no dealer intervention and no partial fills.

Pros

- Extensive range of offerings

- Regulated by FCA (U.K.)

- Emphasis on education & customer service

- Research amenities are industry leading

- Offers protection for client accounts

Cons

- Does not accept U.S. clients

- Differences between Next Generation and MT4

- High CFD spreads for certain indices

- No back-testing or automated trading capabilities

5. IC Markets

IC Markets was founded in Sydney, Australia in 2007 and is regulated by the Australian Securities and Investments Commission (ASIC), as well as the Seychelles Financial Services Authority (FSA). According to the broker’s website, they processed $646 billion worth of trading volume in April 2019 alone.

While the broker offers services and features designed for both beginner and professional traders, the company promote themselves as the ‘go to’ choice for high volume traders, scalpers and trading algos due to their New York Equinix NY4 data centre – processing over 500,000 trades per day.

|

The Best Trading Volume | Overall Rating ⭐️⭐️⭐️⭐️⭐️ |

[button size=”medium” style=”primary” text=”Visit IC Markets” link=”https://www.icmarkets.com/global/fr/” target=”IC Markets”] |

| The online broker is well known in Australia and is considered to be the best online brokerage available in the Country as it offers the highest available leverage in Australia, low spreads and fees, and much more.

The trading brokerage strives to bridge the gap between retail clients and big institutional investors by offering investment solutions that were once only offered by investment banks and high net worth individuals. IC Markets primarily offers their traders forex trading, but also delves into some choices of futures, indices and commodities. |

|||

PROS:

- True ECN broker with institutional grade liquidity.

- MetaTrader and cTrader available on desktop, web and mobile.

- Wide range of tradable products with 24/7 customer support.

- Impressive library of educational material and videos.

CONS:

- Beginner traders may be overwhelmed by the choice of markets and platforms.

6. FP Markets

FP Markets is the brokerage arm of First Prudential Markets Pty Ltd, an Australian firm that was established in 2005. In over 14 years of brokerage operations, FP Markets has grown to become a foremost online forex and CFD broker.

The Head Office is located in Sydney, Australia. The brand has won multiple industry awards in areas like; customer service, trader education and trade execution.

|

Best for Trading Account | Overal Rating ⭐️⭐️⭐️⭐️ |

[button size=”medium” style=”secondary” text=”Visit FP Markets” link=”https://www.fpmarkets.com/” target=”FP Markets”] |

| FP Markets is an international forex broker offering the MT4, MT5 and Iress trading platforms, along with raw spreads and high leverage. This review covers everything from fees and minimum deposits to account registration and live chat support.The award-winning broker offers over 13,000 products, including forex, share CFDs, indices, commodities, and cryptocurrencies. Clients of all levels can choose between ECN or DMA pricing with a range of tools at their disposal. | |||

Pros:

- 15 years in the Forex market;

- favorable trading conditions;

- more than 10,000 trading instruments;

- investment opportunities: MAM and PAMM;

- order execution speed is 40 ms.

Cons

- no cent account type;

- complex verification process.

7. BDSwiss

BDSwiss was founded in 2012 and offers trading accounts regulated under the Mauritius Financial Services Commission and the Cyprus Securities and Exchange Commission.

Users can trade on more than 250+ financial CFD instruments covering Forex, Commodities, Cryptocurrencies, Indices and Equities, on 3 account types called Classic, VIP and Raw on the MetaTrader 4 and MetaTrader 5 trading platforms and the broker’s own BDSwiss Web Trader and BDSwiss Mobile App.

The broker also offers educational events via live analysis and educational webinars and seminars, as well as a beginner to advanced courses in its Trading Academy. Users can also access AutoChartist and live trading alerts via Telegram, depending on account type. Customer service is offered 24/5.

|

Best for Trading Platform | Overal Rating

⭐️⭐️⭐️⭐️ |

[button size=”medium” style=”secondary” text=”Visit BD Swiss” link=”https://global.bdswiss.com/” target=”BD Swiss”] |

| This BDSwiss review provides an overview of the forex and CFD services from BDSwiss to enable you to compare similar brokers. We look at the trading platform, login process and account types, including the RAW account which offers unique trading opportunities and sets BDSwiss apart from rivals.

The broker is a global leader in CFDs and forex trading and has around 1mn client trading accounts. |

|||

Pros:

- Strictly regulated

- Comprehensive and competitive trading conditions despite lack of bonuses and rewards

- Massive variety of tradable options

- Platforms offer lots of advanced features for technical analysis and decision-making

Cons:

- Not an extensive selection of cryptocurrencies

- Welcome bonus, deposit bonus, no deposit bonus and no other broker bonuses offered with first time sign up

- No trading bonus for loyal customers

- No referral bonus offered

8. FlowBank

FlowBank is a Swiss online bank that provides multiple financial solutions, from conventional banking to trading and investing. Having been founded in 2020, the company quickly asserted itself as a reliable partner to retail traders and value investors from Europe and elsewhere. FlowBank’s clients can choose from an impressive assortment of over 50 000 instruments at an above-average cost.

The company is licensed to provide financial services by Switzerland’s main regulatory body, ensuring very high protection. Another major advantage of working with FlowBank is the more than 50,000 instruments made available to traders and investors. Additional benefits include its excellent custom-built platform and its comprehensive research materials.

|

Best for finanncial solutions | Overall Rating ⭐️⭐️⭐️⭐️⭐️ |

[button size=”medium” style=”secondary” text=”Visit FlowBank” link=”http://” target=”FlowBank”] |

FlowBank is an officially licensed bank from Switzerland. This license is excellent since it means we get Swiss banking protection. And it is interesting to note that they are the first bank to be licensed since 2009. They are already employing 90 people in Geneva.In 2021, Coinshares (a sizeable digital asset management company) acquired a 9% stake in FlowBank. And then again, in 2022, they acquired a second 20% stake in the company. This investment gave a significant boost to FlowBank to continue growing. FlowBank is trying to make online banking and trading simpler and more accessible. They are offering a multi-currency bank account and a broker account. |

|||

Pros:

- Free transactions on the Swiss stock exchange

- Very cheap transactions costs

- Relatively cheap currency conversion fees

- They are a licensed bank, so your money is secured for up to 100’000 CHF

- Reasonable custody fees for all portfolios

- Allow trading in fractional shares

- Simple to get started with

- Can trade on many platforms

- They have a demo account to test the system

- Very responsive customer support

Cons:

- They are very new to the market

- We currently do not know anything about their bank offering

Conclusion

In order to select the best CFD Brokers we take into account a wide variety of factors. These include the quality of software available, the trading conditions (eg. spread, leverage), and level of support when you need it. In addition to the ongoing research into the brokerage firms that we conduct, we have also collected information from our readers in the form of user reviews and ratings.