Description

1. Overview of Exness

Exness was founded in 2008 and has since grown into a global Forex and CFD broker with a robust reputation. The broker is regulated by various financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) in Seychelles. With such strong regulatory backing, Exness ensures that client funds are kept safe and that trading practices adhere to industry standards.

One of Exness’s most appealing features is the flexibility it offers in terms of account types, leverage, and low spreads. Whether you’re a novice or an experienced trader, Exness provides an accommodating environment tailored to different levels of trading expertise.

2. Account Types

Exness offers a variety of account types to cater to different trading needs:

- Standard Account: Ideal for beginners, the Standard account offers competitive spreads and no commissions on most trades. It requires only a minimal deposit to get started, making it accessible to traders of all levels.

- Pro Account: This account type is suitable for more experienced traders who need tighter spreads and faster execution speeds. With this account, traders gain access to professional tools and a more customizable trading experience.

- Zero Spread Account: Traders who need more precise cost calculations may find the Zero Spread Account beneficial, as it offers zero spreads on many major currency pairs, with a small commission.

- Raw Spread Account: This is another option for advanced traders, offering some of the lowest spreads on the market, but with a commission on trades.

3. Trading Platforms

Exness supports the industry-leading MetaTrader platforms—MT4 and MT5—which are well-known for their advanced charting tools, automated trading features, and a wide range of technical indicators.

- MetaTrader 4 (MT4): Widely recognized as the go-to platform for Forex trading, MT4 offers a user-friendly interface and highly customizable charts, making it an excellent choice for both beginner and advanced traders.

- MetaTrader 5 (MT5): An upgraded version of MT4, MetaTrader 5 includes more advanced features, including additional time frames and in-depth market depth analysis. It’s particularly suitable for traders who need more comprehensive tools for stock and commodity trading.

- Mobile Trading: Exness also offers mobile versions of the MT4 and MT5 platforms, allowing traders to monitor and manage their accounts on the go. The mobile platform supports full functionality, including charting and trade execution, making it easy to trade from anywhere.

4. Fees and Commissions

Exness is known for its transparency in fees and commissions. The broker offers competitive spreads starting from 0.0 pips on certain accounts, and commissions vary depending on the account type. For example, the Raw Spread account charges commissions as low as $3.50 per lot traded. Exness’s spreads are variable and generally lower compared to other brokers, particularly during times of high liquidity.

Another significant advantage is that Exness does not charge withdrawal fees on most methods, a feature that distinguishes it from many other brokers. Additionally, there are no hidden fees, ensuring traders know exactly what they are paying.

5. Leverage Options

Exness provides incredibly flexible leverage options, with leverage up to 1:2000 for professional accounts, depending on the region and asset traded. For beginners, leverage levels can be lower to mitigate risk. This flexibility allows traders to adjust their risk profile according to their trading strategy, which can be highly beneficial for those looking to optimize their returns.

6. Deposit and Withdrawal Methods

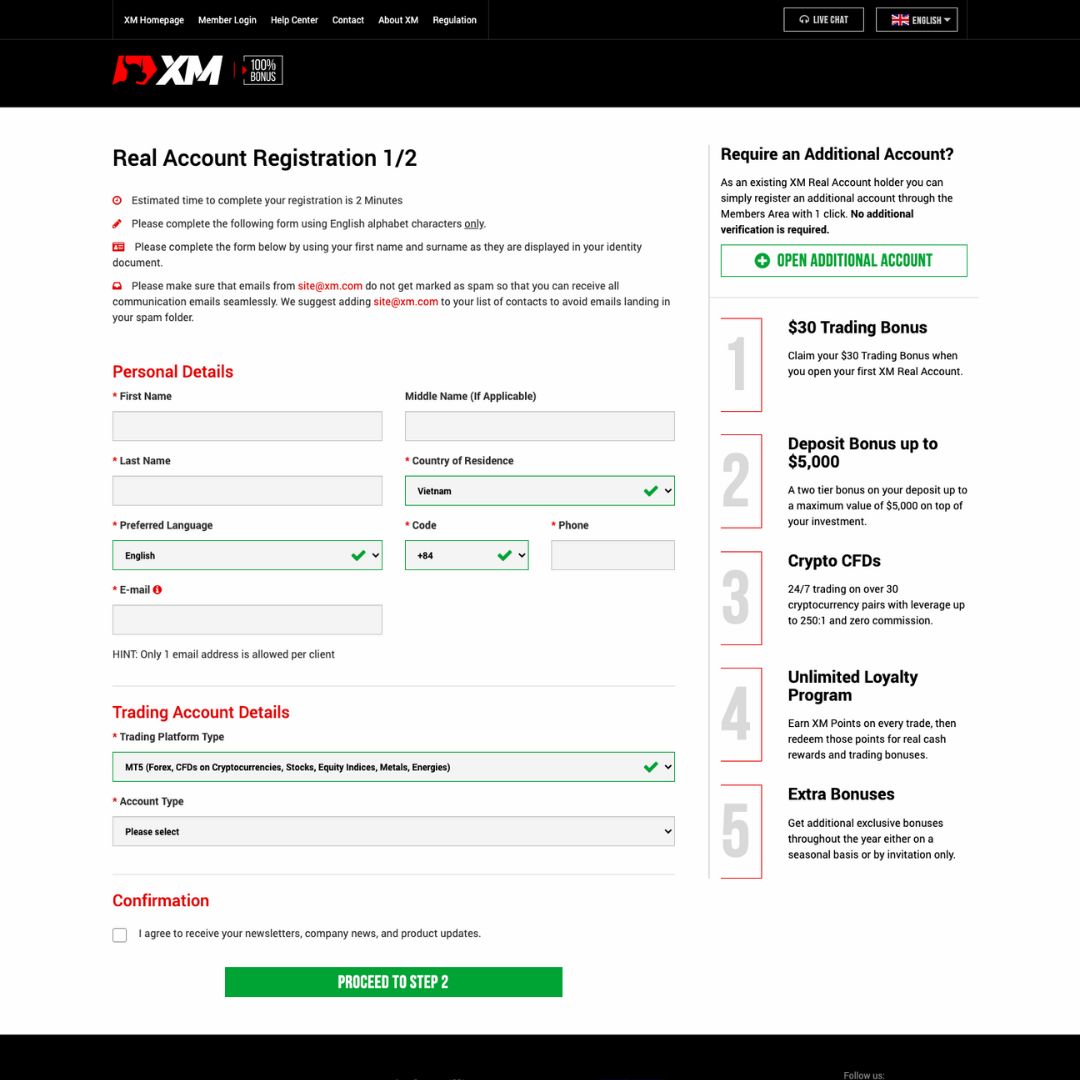

Exness excels in providing quick and efficient deposit and withdrawal methods. Traders can use a wide variety of payment methods, including:

- Bank Transfers

- Credit/Debit Cards

- E-wallets (Skrill, Neteller, etc.)

- Cryptocurrency Payments

One of the most appreciated features is the near-instant withdrawals available through e-wallets and other digital payment methods. Most withdrawals are processed automatically, making Exness a convenient broker for traders who need quick access to their funds. There are no fees on most deposit and withdrawal options, making it even more appealing.

7. Customer Support

Customer support is an area where Exness truly shines. The company offers 24/7 support in multiple languages, including English, Chinese, Russian, and more. This multilingual support ensures that traders from around the world can receive assistance promptly and effectively.

Traders can reach Exness through various channels, such as live chat, email, and phone support. The broker’s live chat is particularly responsive, providing answers in real-time. The FAQ section on the website is also comprehensive, addressing many common questions and issues traders might encounter.

8. Educational Resources

Exness offers a range of educational resources aimed at both new and experienced traders. The broker provides detailed video tutorials, webinars, and articles that cover fundamental and technical analysis, risk management, and trading strategies. These resources are invaluable for traders looking to improve their skills and deepen their understanding of the markets.

Additionally, Exness provides access to an economic calendar and market analysis tools, which are essential for traders who rely on fundamental analysis. These tools help keep traders informed about major market events that could impact their trades.

9. Safety and Regulation

As mentioned earlier, Exness is regulated by top-tier financial authorities, ensuring a high level of trustworthiness. Client funds are kept in segregated accounts, and the broker offers negative balance protection, ensuring that traders cannot lose more than they invest.

Exness also participates in compensation schemes in certain regions, providing an extra layer of security for traders in the unlikely event of insolvency.

10. Conclusion: Is Exness Right for You?

Exness stands out as a reliable and versatile broker that caters to both beginner and professional traders. With its wide range of account types, competitive fees, and excellent trading platforms, it’s no surprise that Exness has become a leading name in the Forex industry.

For traders who value transparency, low fees, and efficient customer support, Exness could be a perfect match. The flexibility of leverage and the convenience of deposit/withdrawal methods further enhance the trading experience, making Exness an excellent choice for traders looking to take their trading to the next level.

However, like any broker, Exness may not be suitable for everyone. Traders who prefer fixed spreads or need access to a broader range of asset classes (such as stocks or ETFs) may need to explore other options. Overall, Exness provides a solid, reliable, and flexible trading experience that should appeal to most Forex and CFD traders.