Description

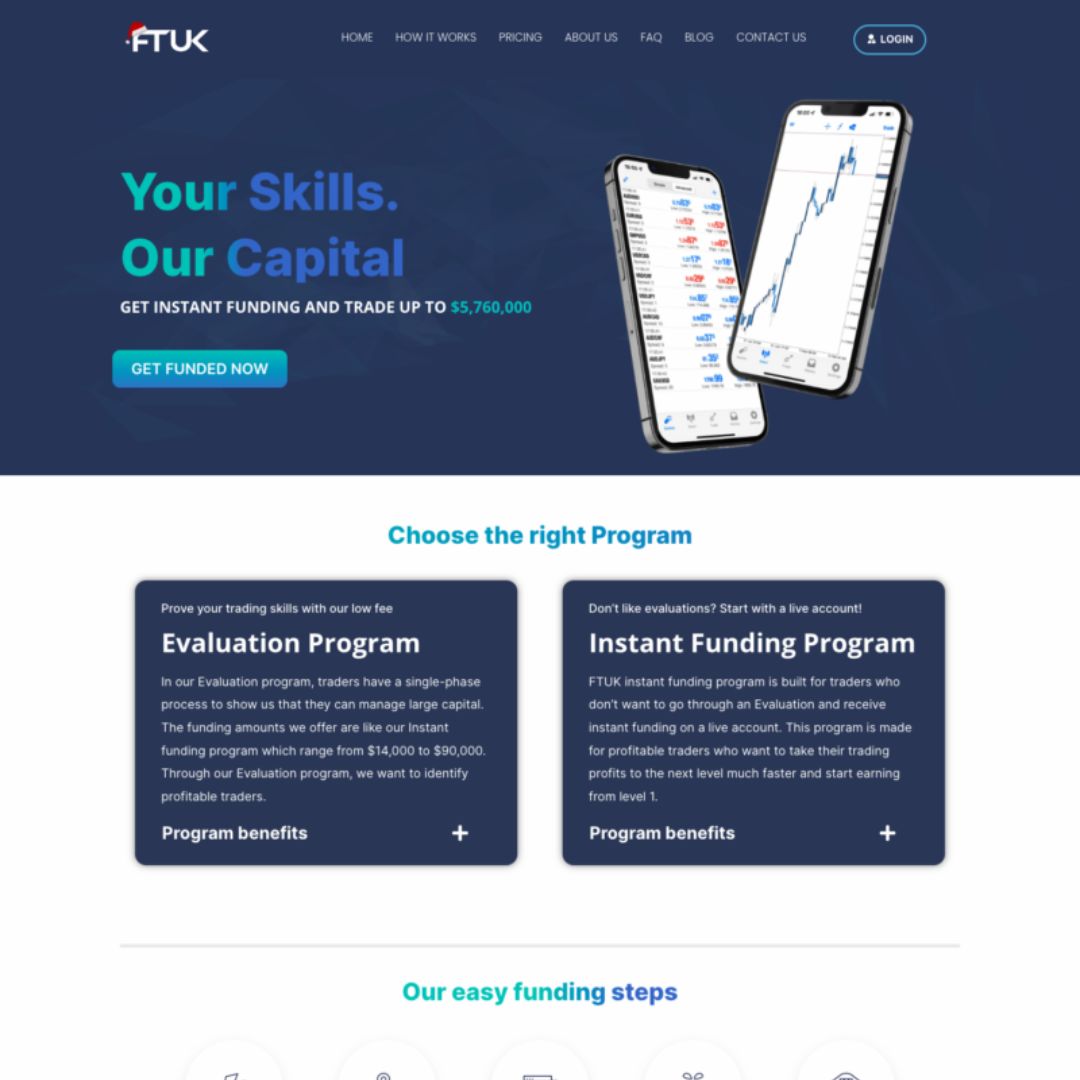

FTUK Overview

FTUK is a proprietary company with offices located in the United Kingdom, London. They offer their traders up to three accounts with a balance of £2,240,000 and use Itexsys as their broker.

They are a registered UK company under FTUK Ltd, with company number 13793849.

You can choose from instant funding and review programs. To be funded in the assessment program, you must pass their 1-Stage Assessment Process. After doing so, you have specific Profit Targets that you must achieve in order to expand your account balance. Upon successful completion, you will be rewarded with a 50-80% profit split and your account balance doubled.

Trading Platform

FTUK has just launched two new trading platforms, traders will now be able to choose MetaTrader 5 or TradingView. In addition, to the previously active MetaTrader 4 trading platform.

MetaTrader 5 will be a great addition since, if you compare it to MetaTrader 4, it provides a wider library of trading instruments with an evolved interface.

TradingView, on the other hand, will also be an attractive option for traders since Eightcap has combined its platforms with TradingView. So for anyone that would enjoy trading with TradingView, you can choose this option and manage your FTUK account directly on TradingView.

Account Types

FTUK provides a scaling account size. A trader starts at level 1 account and can go up to level 7. Each level has an increased account size as well as other benefits. To reach a new level, a trader needs to achieve a profit target.

FTUK offers two types of accounts:

- Low Risk — lower leverage and mandatory 1.5% stop-loss but a lower profit target and more time to reach the target on level 1.

- Aggressive — higher leverage and no mandatory stop-loss but a higher profit target and less time to reach the target on level 1.

FTUK offers two funding programs:

- Evaluation — starts on a demo account at level 1, goes to a live account at level 2. Profit earning starts at level 2. Lower registration fees.

- Instant Funding — starts on a live account at level 1. Profit earning starts at level 1, though the trader needs to reach the level 1 profit target to be able to withdraw funds. Higher registration fees.

Sponsorship Program Options Fees

FTUK offers two different instant capital growth options: low risk and aggressive. You can choose from £2,500, £7,500, £10,000 and £17,500 account sizes expandable from £640,000 up to £2,240,000 in account balance depending on the account size you choose. You can manage three of these accounts, but keep in mind that you can’t merge them.

For low risk accounts between £2,500 and £17,500, you must achieve a profit target of 10% for tier one, multiplied by your account amount four times. Further scaling requires the same 10% profit target and your balance will double each time from £640,000 up to £2,240,000 depending on the account size you choose. You must also respect the 5% maximum loss rule, which you cannot pass.

Prices for low risk account types:

- £2,500 low risk account £150

- £7,500 low risk account £410

- £10,000 low risk account £550

- £17,500 low risk account £950

You must also consider that you are allowed to trade low risk account types with 10:1 leverage, while the maximum stop loss required for each open position is 1.5%. Level one of the program has a maximum completion time of 90 days. Low risk account types offer 50-80% profit splits.

For active accounts between £2,500 and £17,500, you must achieve a profit target of 25% for tier one, multiplied by your account amount four times. Further scaling requires the same 25% profit target and your balance will double each time from £640,000 up to £2,240,000 depending on the account size you choose . You must also respect the 5% maximum loss rule, which you cannot pass.

Prices for active account types:

- £2,500 active account £150

- £7,500 active account £410

- £10,000 active account £550

- £17,500 active account £950

You must also consider that you can trade active account types with 30:1 leverage while maximum stop loss is not required but is recommended as all trades have a P&L of -2.5 % or more will be automatically closed. Level one of the program has a maximum completion time of 90 days. Active account types offer a 50-80% profit split.

Remember you are allowed to trade during weekends, overnight, during news, using EAs, while hedging and scalping (trades need to be open for at least 30 seconds) licensed. Account funds are in GBP.

In addition to instant funding for low-risk and active account types, FTUK also offers a Review program with two different growth options: low-risk and aggressive. You can choose from the following four account sizes:

- Account £10,000 for £119

- Account £30,000 for £299

- £40,000 account for £349

- Account £70,000 for £449

The Evaluation Process is done in 1 Stage, requires a Profit Target of 10% for low risk account types, while active account types require a Profit Target of 25%. You are allowed to trade with 10:1 leverage for low risk accounts, while active accounts allow up to 30:1 leverage. You have a maximum trading period of 90 days and you do not can exceed an absolute reduction of 5%.

Low risk assessment program:

Positive rating program:

FTUK offers account funds in USD, EUR or GBP. You are allowed to trade on Meta Trader 4 where you can trade forex pairs, metals, indices and commodities.

Leverage

Leverage on the low-risk account is limited to 1:10, whereas it is 1:30 on aggressive accounts, so I personally recommend avoiding the low-risk option unless you want to trade more frequently but with very little risk per trade.

Customer Support

FTUK has a FAQ page where you might find the information that you are missing.

The support team is available on their social media, or you can directly contact them on their email support@ftuk.com.

Their office hours are Monday – Friday 09:00 – 18:00 GMT.

You can also contact FTUK for any further information through telephone number +44 (20) 8798 2605.

FAQ

Do I need to use a stoploss on all my trades?

Yes! The company requires you to use a stoploss on every trade you place. On the low-risk program, this needs to be set at a maximum of 1.5%.

Aggressive accounts don’t require a stoploss but they strongly advise you to use one. All trades on account with a PnL of -10% or greater will be automatically closed.

How does Forex Traders UK absolute drawdown work?

All funded accounts come with fixed equity stop-out level which is the starting balance – 5%. This is a fixed value and won’t trail up nor down and means that any profit made will increase the loss allowance.

Example: On a £10,000 funded account, the equity stop-out level is set at £9,500. The account has realized a profit of £800, this means that the total loss allowance is now £500 + 800 = £1,300

When will I get paid?

Allow up to 2 working days for the pay-out to be processed. The amount of time for the pay-out to reach your account can vary depending on the payment method.