Description

Overview

IFC Markets provides its trading services for more than a decade to over 165k+ clients through unlimited trading instruments and numerous opportunities. IFC Markets is a part of the IFCM group of companies that are involved in the development of projects in the field of financial technologies with the requirements set by international legislation to provide financial services.

- The trading proposal is mainly based on CFD trading with a good range of trading instruments and platforms, which we will see further in detail in our IFC Markets Review.

- The broker provides 600+ trading instruments in 18 languages across 80 countries following STP pricing model with quotes being provided directly from liquidity providers

Being a Cyprus-established broker, IFC Markets offers an attractive and regulated proposal, yet international coverage is done through additional entities in BVI and Malaysia Labuan.

Regulation Review

IFC Markets is regulated by the British Virgin Island Financial Services Commission (BVI FSC). The reputation of this regulatory board is questionable due to the limited thresholds for companies to register. With that said, the brokerage does assure that client funds are held in segregated accounts.

IFCM Cyprus Limited also complies with MiFID and is authorised by the Labuan Financial Services Authority.

Trading Platform

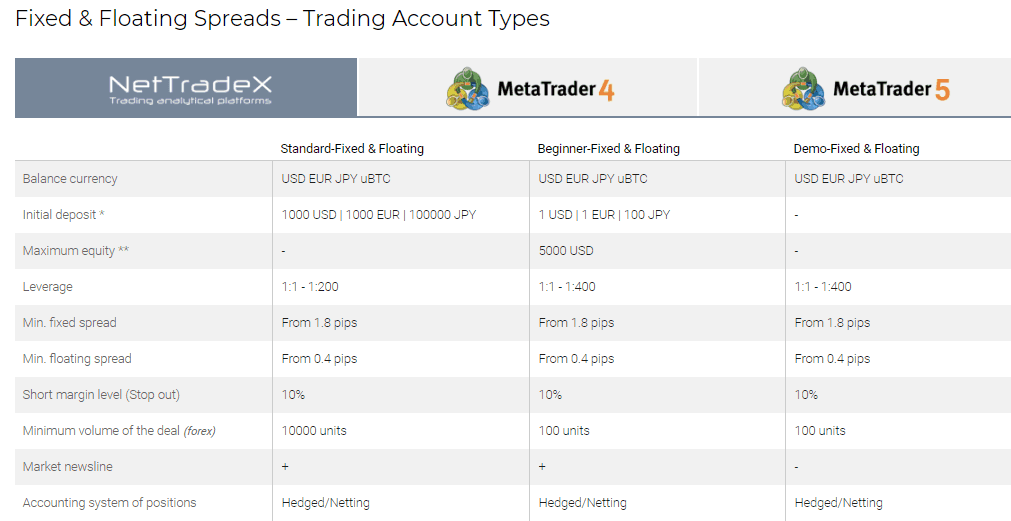

IFC Markets offers 3 types of trading platforms, including NetTradeX, MT4 and MT5.

- MT4 and MT5 are the 2 most basic and popular platforms in Forex trading with many outstanding features and many supporting tools.

- NetTradeX: this is IFC Markets’ own platform, but it is considered quite difficult to use. This platform supports automated trades EAs, but NetTradeX only supports desktop and mobile, no web version.

Exchange fees

- Leverage: the maximum leverage that IFC Markets supports depends on the account type and the amount in the account, the larger the amount, the smaller the maximum rate and each different trading product also has a different rate. Maximum leverage varies, the highest is 1:400. With such low leverage, it is difficult for IFC Markets to compete with other brokers in the market.

- IFC Markets only applies a commission for stock trading of 0.1%/trading volume for each position opened or closed, for US stocks it is $0.02 per share.

- Spread: high fixed spread, the lowest floating spread from 0.4, but in fact, when trading on a real account at IFC Markets, the high floating spread is almost equivalent to the fixed spread.

| Forex | Standard Spread | Lowest Float Spread |

| EUR/GBP | 1.8 | 1.4 |

| EUR/USD | 1.8 | 0.4 |

| AUD/USD | 2.0 | 0.5 |

| NZD/USD | 3.0 | 2.4 |

| USA/CAD | 3.0 | 0.5 |

| USD/CHF | 2.0 | 0.6 |

| USD/JPY | 1.8 | 0.5 |

Account Type

We found three account types Standard, Beginner, and Demo accounts provided by IFC Markets with balance currency USD, EUR, JPY, and uBTC so easy transfers are available, either with fixed or floating spreads for each of the trading platforms. A higher grade account will bring better conditions as well as lowering maximum leverage to a 1:200 but requires deposits from 1,000$.

- The IFCM free Demo account operates with virtual funds and is intended for studying or the functional purpose to test strategies.

Also, you may get VIP status and get flexible trading conditions, exclusive personal instruments, free access to a VPS, 0 commissions on deposits and withdrawals, and much more.

Payment Methods

We found that IFC Markets allows deposits in several base currencies: USD/EUR/JPY. Any fees are directly associated with the payment method rather than a commission for the broker.

- IFC Markets Funding Methods we ranked with an overall rating of 8 out of 10. The minimum deposit is among the lowest ones in the industry, Fees are either 0 or very small with various account-based currencies, yet deposit options vary on each entity

Here are some good and negative points for IFC Markets funding methods found:

| IFC Markets Advantages | IFC Markets Diasadvantages |

|---|---|

| Some methods are free of charge | Minimum deposit and conditions vary according to the entity |

| Very low minimum deposit – 1$ | Deposit and withdrawal fees |

| Wide range of payment methods supported |

Deposit Options

The payment methods include a range of world-leading payment providers, thus the IFCM supports Wire Transfers, Bank Cards, WebMoney, Skrill, Neteller, OKPAY, Unistream, and transfers between own trading accounts.

What is minimum deposit?

The minimum IFC Markets account opening requirement is $100 as a start for Beginning account based either on floating or fixed spread (Find the best-fixed spread forex broker by the link) demand only. The deposit minimums are diversified by the funding option along with applicable commissions or without them.

IFC Markets minimum deposit vs other brokers

| IFC Markets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawals

IFC Markets made a promotion to cover fees for deposits or withdrawals. Yet, this is applicable to some IFC Markets withdrawal methods, which you should check with customer service as there are some differences between the countries of origin. Some deposits will also add on processing fees and others are offered for free for example Credit Card payment.

For the withdrawals, you can use the same methods along with application to the option commissions and minimum amounts that are allowed for transfer, which is defined by every provider. E.g. Card transfers minimum is 10$ with 2% + 7.50$ commission above, while CashU charges no fees.

Customer Support

What we also want to highlight is the excellent customer support that is provided in 18 languages through the constant availability and multiple contact ways that are available through IFC Markets’ established entities. The customer support is knowledgeable and quick and includes 24/5 commitment.

- Customer Support in IFC Markets is ranked Excellent with an overall rating of 9 out of 10 based on our testing. We got some of the fastest and most knowledgeable responses compared to other brokers, the only disadvantage is that it’s not available 24/7

Accepted Countries

IFC Markets accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use Markets from United States, Japan, Russian Federation.

FAQ