What Are The Best Indicator Settings & Timeframes?

Source: ( TradingView )

Timeframes and technical indicator settings are ubiquitous concepts to technical analysts. Two things that they will have to interact with at some point in point. For certain traders, they make part of the million-dollar questions:

- “What is the best timeframe to use?”

- “What are the best indicator settings to use?”

Where “best” refers to the timeframe/settings that lead to the most profits. Both questions are very interesting and very difficult to answer, yet traders have tried to answer both questions.

1. What Is The Best Timeframe To Use?

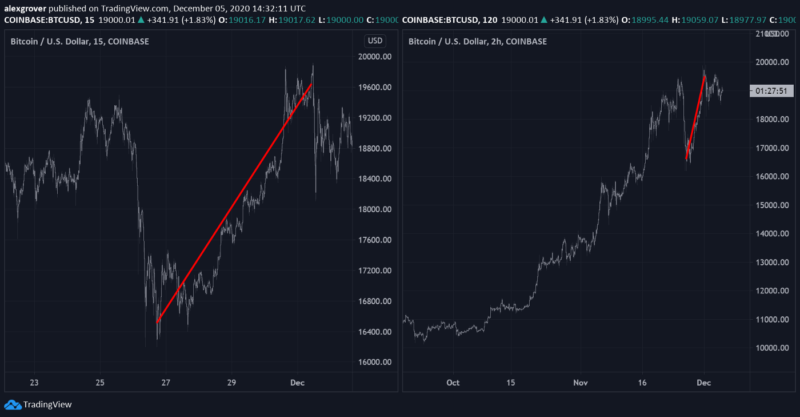

Timeframes determine the frequency at which prices are plotted on a chart and can range from 1 second to 1 month. We can notice that price charts tend to be similar to each other from one timeframe to another, having the same irregular aspect and the same patterns, this explains the fractal nature of market prices, where shorter-term variations make up of longer-term variations found in a higher time-frame.

Based on this particularity, methods used to determine the start/end of a trend can be the same regardless of the selected time-frame, as such traders could choose a time-frame based on the trend they want to trade, for example, daily/weekly timeframes could be used to trade primary trends while other could use intraday timeframes to trade intraday trends, note that it is still possible to trade a specific trend by using any time-frame you want, however using a timeframe that is too low for trading long term trends might result in an excess of parasitic information.

While using a high timeframe for trading short term trends will result in a lack of information.

It is important to note that lower time-frames will return price change of lower amplitude, as such trading the variations of a lower timeframe will make a trader more affected by frictional processes, particularly frictional costs, as such trading lower time-frames aggressively might require more precision, which is why beginner traders should stick with higher time-frames.

So “the best timeframe to use” should be chosen based on the trend the trader tradingview.com/ideas/mtfawants to trade. With a timeframe giving the right amount of information to trade the target trend optimally. Your target trend will depend on your trader profile (risk aversion, trading horizon…etc).

1.1 Multi Timeframe Analysis

2. Best Technical Indicators Settings

When using technical indicators, reducing whipsaw trades often introduce worse decision timing. Finding settings that minimize whipsaw trades while keeping an acceptable amount of lag is not a simple task.

Most technical indicators have user settings, these can be numerical, literal, or Boolean and allows traders to change the output of the indicator. In general, the main setting of a technical indicator allows making decisions over longer-term price variations, as such traders should use indicator settings in order to catch variations of interest like one would do when selecting a timeframe, however, technical indicator settings often allow for a greater degree of manipulation, and can have a wider range of values, as such setting selection is often conducted differently.

2.2 Indicator Settings From Optimization

When using technical indicators to generate entry rules it is common to select the settings that yield the most profits. Various methods exist in order to achieve optimization, certain software will use brute force by backtesting a strategy for every indicator setting. It is also possible to use more advanced procedures such as genetic algorithms ( GA ).

GA’s are outside the scope of this post but simply put GA’s are a search algorithm mimicking natural selection and are particularly suitable for multi-parameter optimization problems. When using a GA the setting is as genes in a

chromosome.

Such a selection method has some limitations. The most obvious being that optimal settings might change over time, rending useless the process of optimization. Optimization can also take a large amount of time when done over large datasets or when using a large combination of indicator settings, it might be more interesting to analyze the optimized settings of a technical indicator over time and try to find a relationship with market prices.

2.3 Dominant Cycle Period For Setting Selection

Certain technical analysts are made the hypothesis that the dominant cycle period should use as a setting for technical indicators than a fixed value, this method is use a lot in J. Elhers technical indicators. Most technical indicators using the dominant period as a setting are bandpass filters. Which preserve frequencies close to the dominant one.

There are several limitations to such a selection method. First, it depends a lot on the accuracy and speed of the dominant cycle period detection algorithm used. The noisy nature of the price makes it extremely difficult to measure the dominant period accurately and in a timely manner. In general, more accurate methods will have more lag as a result. Another downside is that it is not a universal solution, technical indicators can process market price differently.

3. Conclusion

From the two questions highlighted at the start of this post the one involving technical indicators remains the most challenging one to answer. Which is often the case with “what is the best…” kind of questions. What is certain is that there isn’t a universal setting for each indicator. Certain settings might be more adapted to specific market conditions (such as ranging or trending conditions). And the presence of a setting in itself will always mean that interaction will occur at some point. As such recommending an indicator setting or timeframe must be done with a significant rationale.The problem of the best technical indicator settings offer a great challenge for any technical indicator developer. But it is important for the common traders to lose some focus about them. While important, these should not be adjusted in opposition to your trader profile. Having a well-defined trader profile will help you adjust these settings more effectively, as such a reasonable answer to “what are the best timeframe/indicator settings?”. Could be “the ones that are adapted to your trader profile”.