What Is A Market Index?

A stock market index tracks the ups and downs of a chosen group of stocks or other assets. Watching the performance of a market index provides a quick way to see the health of the stock market. Guides financial firms in the creation of index funds and exchange-traded funds (ETFs). And helps you gauge the performance of your investments.

What Is a Market Index?

A market index tracks the performance of a certain group of stocks, bonds or other investments. These investments are often grouped around a particular industry, like tech stocks, or even the stock market overall, as is the case with the S&P 500, Dow Jones Industrial Average (DJIA) or Nasdaq.

There’s no set size when it comes to market indexes. The DJIA contains just 30 stocks while the CRSP index has more than 3,700. What’s important is that each contains a large enough sample size to represent the overall behavior of the economic sliver they aim to represent.

How Stock Market Indexes Are Constructed

Each stock market index uses its own proprietary formula when determining which companies or other investments to include.

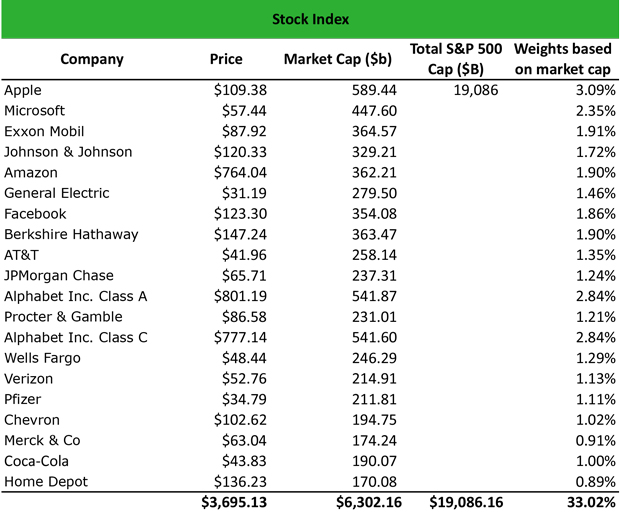

Indexes that measure the performance of broad swathes of the market may only include companies that rank highly in terms of market capitalization, or the total value of all of their outstanding shares. Alternatively, they may be selected by an expert committee or simply represent all of the shares that trade on a certain stock exchange.

Once an index manager has determined which companies to include, they then need to determine how those companies are represented in the index, a factor called index weighting. Depending on weighting, all companies included in an index can have an equal impact on index performance or a different impact based on market capitalization or share value.

The three most common index weighting models are:

- Market-Cap Weighted: In a market cap-weighted index, the index more heavily represents stocks with higher market caps. With this structure, large companies have a bigger impact on the index’s performance.

- Equal Weighted: With an equal-weighted index, the index treats all components the same. This means each company’s performance affects the index the same amount, whether they’re incredibly large companies or incredibly small.

- Price Weighted: A price-weighted index grants each company a different weight based on its current share price. Companies with larger share prices have more clout in these indexes, regardless of how big or small the companies actually are.

Major Stock Market Indexes

There are thousands of indexes in the investing universe. To help you get your bearing, here are the most common indexes you’ll probably encounter:

The S&P 500 Index

One of the most well-known indexes, the S&P 500 tracks the performance of 500 top companies in the U.S., as determined by a committee at S&P Dow Jones Indices. The S&P 500 is a market-capitalization-weighted index.

The Dow Jones Industrial Average

The DJIA is relatively narrow in scope, tracking the performance of just 30 U.S. companies as selected by S&P Dow Jones Indices. The stocks within the DJIA come from a range of industries. From healthcare to technology, but are united by all being blue chip stocks. This means they have a history of strong financial performance. The DJIA is one of the few price-weighted market indexes.

The Nasdaq 100

The Nasdaq 100 tracks the performance of 100 of the largest and most actively traded stocks listed on the Nasdaq stock exchange. Companies within the Nasdaq can be in many different industries, but they generally veer toward tech and don’t include any members of the financial sector. The Nasdaq 100 uses a market-cap weighting.

The NYSE Composite Index

The NYSE Composite Index is a comprehensive index that tracks the performance of all stocks traded on the New York Stock Exchange (NYSE). The index is modified market capitalization weighting.

The Russell 2000 Index

While other stock market indices focus on the largest companies in a particular segment, the Russell 2000 measures the performance of 2,000 of the smallest publicly traded domestic companies. The Russell 2000 is a market-capitalization-weighted index.

The Wilshire 5000 Total Market Index

The Wilshire 5000 Total Market tracks the performance of the entire U.S. stock market. The index is weight base on market capitalization.

Different Types of Market Indexes

While the indexes covered above generally are used as proxies for the overall stock market, there are countless more indexes out there, many of which are tailored to represent very specific segments of the market.

- Environmental, Social, and Governance. ESG indexes focus on companies that score well on measures of how they treat the environment, their employees, their management and society at large.

- Currency Indexes. The U.S. Dollar Index is a currency index that measures the strength of the U.S. dollar relative to a basket of other leading global currencies.

- Global Indexes. As their name implies, global indexes allow you to track the collective performance of all of the companies in the world.

- National Indexes. Just as the major stock market indexes above track the performance of the U.S. market. There are indexes following the highs and lows of companies in almost every country.

- Growth Indexes. Growth indexes track the performance of leading growth stocks, or those stocks of companies that are targeting faster growth than the overall market.

- Value Indexes. Value indexes, on the other hand, group together companies that are consider to be undervalue by investors based on their finances.

- Sector Indexes. Sector indexes are tracking the performance of specific industries, like technology, finance, healthcare, consumer goods and transportation.

How to Invest in Stock Market Indexes

Because they follow the performance of a mix of companies and investments. Funds based on leading indexes are consider as an excellent way to invest quickly, easily and cheaply. Index funds and exchange-traded funds (ETFs) provide access to a ready-made diversified portfolio of stocks and bonds and are what many investing gurus, like Warren Buffett, swear by.

What’s great about index funds and ETFs is you can invest in them at just about any brokerage with any amount of money. Look to our listing of the best brokerages.

If you aren’t sure what investment options are best for you. You may want to talk with a financial planner, who can help you create a personalized plan based on your goals. Or check out our ranking of the best index funds.