What Is Liquidity?

Liquidity refers to the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price. The most liquid asset of all is cash itself.

Understanding Liquidity

In other words, liquidity describes the degree to which an asset can be quickly bought or sold in the market at a price reflecting its intrinsic value. Cash is universally considered the most liquid asset because it can most quickly and easily be converted into other assets. Tangible assets, such as real estate, fine art, and collectibles, are all relatively illiquid. Other financial assets, ranging from equities to partnership units, fall at various places on the liquidity spectrum.

For example, if a person wants a $1,000 refrigerator, cash is the asset that can most easily be used to obtain it. If that person has no cash but a rare book collection that has been appraised at $1,000, they are unlikely to find someone willing to trade them the refrigerator for their collection. Instead, they will have to sell the collection and use the cash to purchase the refrigerator. That may be fine if the person can wait for months or years to make the purchase. But it could present a problem if the person only had a few days. They may have to sell the books at a discount. Instead of waiting for a buyer who was willing to pay the full value. Rare books are an example of an illiquid asset.

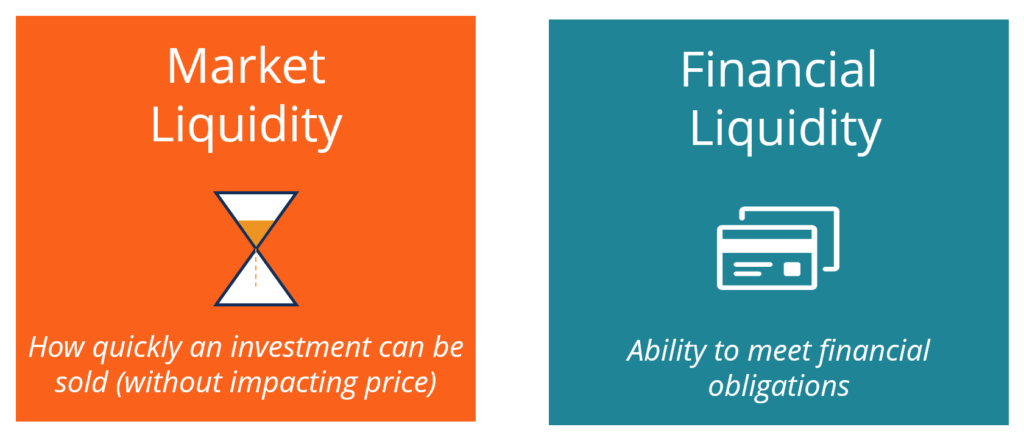

There are two main measures of liquidity: market liquidity and accounting liquidity.

Market Liquidity

Market liquidity refers to the extent to which a market, such as a country’s stock market or a city’s real estate market, allows assets to be bought and sold at stable, transparent prices. In the example above, the market for refrigerators in exchange for rare books is so illiquid that, for all intents and purposes, it does not exist.

The stock market, on the other hand, is characterized by higher market liquidity. If an exchange has a high volume of trade that is not dominated by selling. The price a buyer offers per share (the bid price) and the price the seller is willing to accept (the ask price) will be fairly close to each other.

Investors, then, will not have to give up unrealized gains for a quick sale. When the spread between the bid and ask prices tightens, the market is more liquid. When it grows the market instead becomes more illiquid. Markets for real estate are usually far less liquid than stock markets. The liquidity of markets for other assets, such as derivatives, contracts, currencies, or commodities, often depends on their size, and how many open exchanges exist for them to be traded on.

Accounting Liquidity

Accounting liquidity measures the ease with which an individual or company can meet their financial obligations with the liquid assets available to them—the ability to pay off debts as they come due.

In the example above, the rare book collector’s assets are relatively illiquid and would probably not be worth their full value of $1,000 in a pinch. In investment terms, assessing accounting liquidity means comparing liquid assets to current liabilities, or financial obligations that come due within one year.

There are a number of ratios that measure accounting liquidity, which differ in how strictly they define “liquid assets.” Analysts and investors use these to identify companies with strong liquidity. It is also considered a measure of depth.

Ranking of Market Liquidity (Example)

Below is an example of how many common investments are typically ranked in terms how quickly and easily they can be turned into cash (of course, the order may be different depending on the circumstances).

Liquidity rankings:

- Cash

- Foreign Currency (FX)

- Guaranteed Investment Certificates (GICs)

- Government Bonds

- Corporate Bonds

- Stocks (publicly traded)

- Commodities (physical)

- Real Estate

- Art

- Private Businesses

As you can see in the list above, cash is, by default. The most liquid asset since it doesn’t need to be sold or converted (it’s already cash!). Stocks and bonds can typically be converted to cash in about 1-2 days, depending on the size of the investment. Finally, slower-to-sell investments such as real estate, art, and private businesses may take much longer to convert to cash (often months or even years).

Financial Liquidity

Items on a company’s balance sheet are typically listed from the most to the least liquid. Therefore, cash is always listed at the top of the asset section, while other types of assets, such as Property, Plant & Equipment (PP&E), are listed last.

In finance and accounting, the concept of a company’s liquidity is its ability to meet its financial obligations. The most common measures of liquidity are:

- Current Ratio – Current assets minus current liabilities

- Quick Ratio – The ratio of only the most liquid assets (cash, accounts receivable, etc.) compared to current liabilities

- Cash Ratio – Cash on hand relative to current liabilities