10 Best High Leverage Forex Brokers Reviewed

In this guide, we explore the best high leverage brokers in the market today – not only in terms of limits, but fees, supported assets, account minimums, and more.

Leverage allows investors to trade with more money than they have in their brokerage account. The higher the leverage on offer, the more trading capital the investor has access to.

Best High Leverage Brokers

The list below covers many of the top high leverage forex brokers on the market right now:

- eToro – Overall Best High Leverage Forex Broker

- XTB – Up to 500:1 Leverage

- Vantage – High Leverage CFD Trading Forex Broker

- Pepperstone – Top Broker for Raw Spread Accounts

- AvaTrade – Leverage of up to 1:400 Depending on Client Location

- Skilling – Access Leverage of 1:500 on Major FX Pairs

- Forex.com – Best High Leverage Broker for US Clients

- Interactive Brokers – Access to Interbank Currency Quotes

- FBS – Highest Leverage in the Market at up to 1:3000

- HotForex – High Leverage Broker With Limits of up to 1:1000

Best High Leverage Brokers Reviewed

It is important to note that regulated forex brokers can only offer certain leverage limits to traders – which are based on the individual’s country of residence.

Limits are also determined based on whether the trader is a retail or professional client, as well as the respective asset class.

Nonetheless, in the sections below, we compare the 10 best high leverage brokers in the market right now.

1. eToro – Overall Best High Leverage Forex Broker

We found that eToro came in at a close second when reviewing the best high leverage brokers. This low spread forex broker is used by over 25 million clients and it supports thousands of financial instruments. It is inclusive of more than 2,500 commission-free stocks and ETFs.

Those looking at where to buy stocks with leverage might consider trading CFDs at eToro. In doing so, leverage of up to 1:5 will be offered and both long and short positions are supported. Alternatively, eligible clients will also be able to buy cryptocurrency CFDs with leverage of up to 1:2.

The highest leverage

limit available to retail clients is 1:30 – and this will be offered on major forex pairs. With that being said, eToro offers professional accounts that come with a maximum leverage ratio of 1:400. This will, however, require the trader to meet certain eligibility requirements – such as having a minimum investment portfolio of €500k.

What we really like about eToro is that the platform offers a Copy Trading tool that consists of thousands of verified traders. Once a trader has been selected, the user can elect to copy all future positions automatically. This leading forex copy trading platform also offers Smart Portfolios that offer passive access to dozens of investment strategies.

eToro is also one of the best social trading crypto platforms. This feature allows eToro traders to share investment ideas and even comment on and ‘Like’ posts. When it comes to safety, eToro is regulated not only by the SEC, FCA, ASIC, and CySEC, but it has been operational since 2007. Those wishing to try eToro for the first time might consider using the demo stock trading account.

Furthermore, for those looking for the best forex bonuses in 2022, eToro offers a $250 bonus after its users deposit $5k or more into their live trading accounts. Read our guide on the best forex bonus offers for more details.

FX Pairs |

49 |

Max Leverage |

1:30 for retail clients |

Commission |

0% stocks and ETFs, spread-only on CFDs |

EUR/USD Spread |

From 0.6 pips |

Other Assets |

Stocks, ETFs, indices, commodities, cryptocurrencies |

Platforms |

Web trader, mobile app |

US Clients |

Yes – but for real stocks and cryptocurrencies only |

Brokerage Type |

Broker-dealer, CFD broker |

What We Like

- Regulated by multiple financial bodies

- Very user-friendly trading platform

- Spread-only trading model on forex and other CFDs

- 0% commission on real stocks and ETFs

- One of the best swap-free account brokers on the market

- Supports Copy Trading and Smart Portfolios

- Top mobile app for iOS and Android

2. XTB – Up to 500:1 Leverage

XTB offer up to 500x leverage depending on the client’s location and tight spreads from 0.1 pips on dozens of FX trading pairs as well as 2100+ global markets and 1500+ CFD markets in total, covering a wide range of financial assets.

Beginners can use their free educational materials to get a comprehensive education on trading and the optimal use of leverage.

This award winning broker also offers active trader rewards such as cashback and customized trade alerts, including trade recommendations from major banks like Goldman Sachs.

Fast and highly qualified support staff are available for XTB traders 24 hours a day, five business days a week.

FX Pairs |

48+ currency pairs |

Max Leverage |

1:500, or 1:30 for retail clients |

Commission |

0% |

EUR/USD Spread |

From 0.1 pips |

Other Assets |

Shares, indices, commodities, cryptocurrencies |

Platforms |

xStation, MT4 |

US Clients |

No |

Brokerage Type |

CFD broker |

What we like:

- 24 hour support

- 1500+ CFD markets: Forex, Indices, Commodities, Shares & Cryptocurrencies

- Tight spreads from 0.1 pips

3. Vantage – High Leverage CFD Trading Forex Broker

An Australian-based brokerage, Vantage is a CFD trading platform that is regulated by the FCA, ASIC and the VFSC. Notably, Vantage offers CFD trading options for 44 FX pairs – such as EUR/USD, GBP/USD and AUD/USD. A STP/ECN broker, investors can begin trading with two different account types.

An Australian-based brokerage, Vantage is a CFD trading platform that is regulated by the FCA, ASIC and the VFSC. Notably, Vantage offers CFD trading options for 44 FX pairs – such as EUR/USD, GBP/USD and AUD/USD. A STP/ECN broker, investors can begin trading with two different account types.

The standard STP account requires a minimum deposit of $200 – which can be made using a debit/credit card, bank transfer or via an e-wallet such as PayPal, Skrill, Neteller and more. With the STP account, clients can access commission-free FX trading. However, this account charges high spreads. For example, the popular EUR/USD pair charges a high spread of 1.1 pips.

The second account type is the Raw ECN account – which requires a minimum deposit of $500. With the ECN account, investors can access low-spread FX pairs. The EUR/USD pair offers low spreads, starting at 0.2 pips. However, a small commission is charged per lot.

One of the best high leverage brokers for forex, Vantage allows investors to access up to 1:100 leverage on trades. This means that for every $100 you are trading, you are able to access $10,000 worth of currency. The platform also allows leverage options up to 1:500 for certain approved accounts that are trading with higher amounts of equity.

Apart from Forex, traders can access CFD options for cryptos, shares, commodities and indices with Vantage. The platform is available with MT4 & MT5 traders, and also offers a mobile app on iOS and Android.

FX Pairs |

44 FX pairs |

Max Leverage |

1:100 (1:500 for certain accounts with higher equity) |

Commission |

No commission on STP accounts/average $3 commission on ECN accounts |

EUR/USD Spread |

1.1 pips on STP/ 0.2 pips on ECN account |

Other Assets |

CFDs via stocks, indices, commodities, cryptocurrencies |

Platforms |

MT4, MT5, Mobile app |

US Clients |

No |

Brokerage Type |

CFD |

What We Like

- Multi-asset CFD trading platform

- 0% commission on STP account

- Low spreads on EUR/USD on ECN account

- MT4 & MT5 Trader available

4. Pepperstone – Top Broker for Raw Spread Accounts

![]() The next option to consider from our list of the best high leverage brokers is Pepperstone. This provider offers more than 1,200 trading instruments – all of which can be accessed via CFDs. This covers ETFs, stocks, cryptocurrencies, forex, and more.

The next option to consider from our list of the best high leverage brokers is Pepperstone. This provider offers more than 1,200 trading instruments – all of which can be accessed via CFDs. This covers ETFs, stocks, cryptocurrencies, forex, and more.

In addition to fast execution speeds, we like that Pepperstone offers customer service on a 24/7 basis. Another reason that Pepperstone came out as one of the best high leverage brokers is that it offers raw spread accounts. This offers direct access to other market participants and thus – major instruments like EUR/USD can be traded on a zero-spread basis.

Commissions on raw spread accounts are super competitive too at just $3.50 for each currency lot traded. In terms of its leverage offering, Pepperstone is limited to 1:30 – should the retail client be based in the UK, Europe, or Australia. However, the platform does offer limits of up to 1:400 to retail clients in certain other jurisdictions. Professional clients can access up to 1:500.

FX Pairs |

Dozens of majors, minors, and exotics |

Max Leverage |

Up to 1:400 for retail clients |

Commission |

$3.50 for 1 lot traded on raw spread account |

EUR/USD Spread |

0 pips on raw spread account |

Other Assets |

CFDs via stocks, indices, commodities, cryptocurrencies, currency indices |

Platforms |

MT4, MT5, cTrader, TradingView |

US Clients |

No |

Brokerage Type |

CFD |

What We Like

- One of the best high leverage trading platforms for low spreads

- Supports multiple trading platforms

- 0% commission accounts are also available

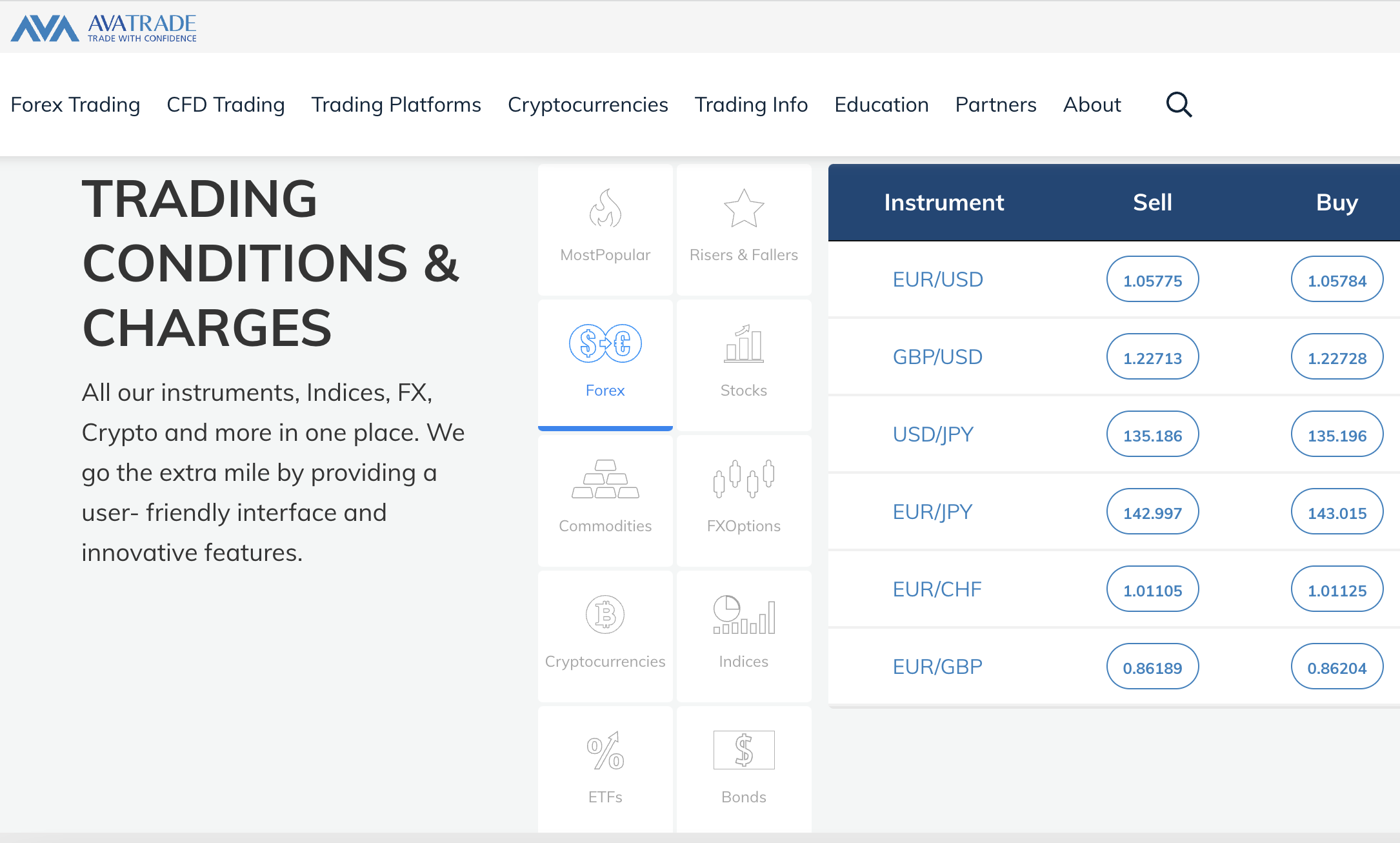

5. AvaTrade – Leverage of up to 1:400 Depending on Location

Retail clients looking for the best high leverage broker might consider AvaTrade. The reason for this is that AvaTrade offers leverage of up to 1:400. This is, however, dependent on the location of the trader and the respective asset class.

Retail clients looking for the best high leverage broker might consider AvaTrade. The reason for this is that AvaTrade offers leverage of up to 1:400. This is, however, dependent on the location of the trader and the respective asset class.

For instance, those based in locations such as the UK, Europe, or Australia will be capped to the standard 1:30 limit. However, traders in jurisdictions where leverage caps do not apply will likely be offered much higher limits. Professional clients are also catered to at AvaTrade, which will often attract triple-digit leverage ratios.

In terms of supported markets, AvaTrade is a CFD broker. Across over 1,200 financial instruments, account holders will be able to access stocks, indices, cryptocurrencies, commodities, and more. The minimum first-time deposit requirement at AvaTrade is set at an affordable $100 and free demo accounts are offered to all registered users.

FX Pairs |

55 |

Max Leverage |

Up to 1:400 |

Commission |

0% |

EUR/USD Spread |

From 0.9 pips |

Other Assets |

CFDs via stocks, indices, commodities, cryptocurrencies |

Platforms |

Web trader, mobile app, MT4, MT5, DupliTrade, ZuluTrade |

US Clients |

No |

Brokerage Type |

CFD (market maker) |

What We Like

- Supports multiple third-party platforms

- Leverage of up to 1:400 for retail clients

- Lots of advanced trading tools

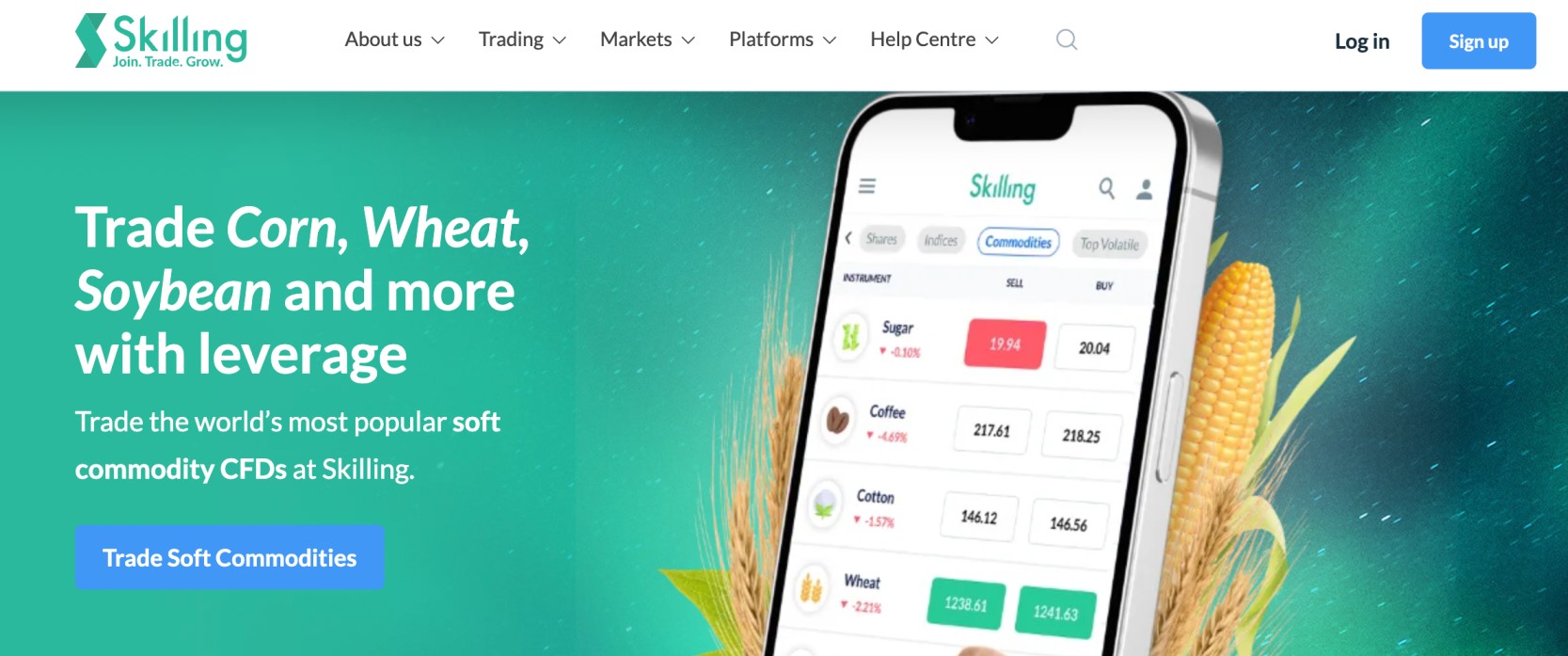

6. Skilling – Access Leverage of 1:500 on Major FX Pairs

Skilling is another option worth considering for retail clients in the market for the best high leverage broker. This user-friendly trading platform offers a maximum leverage ratio of 1:500 on a number of major FX pairs. This means that the upfront margin requirement amounts to just 0.20%.

Skilling is another option worth considering for retail clients in the market for the best high leverage broker. This user-friendly trading platform offers a maximum leverage ratio of 1:500 on a number of major FX pairs. This means that the upfront margin requirement amounts to just 0.20%.

Examples here include EUR/USD, GBP/USD, and AUD/USD. Minor FX pairs and gold can be accessed with a maximum leverage ratio of 1:200, while other commodities are capped at 1:100. Cryptocurrencies can be traded with leverage of up to 1:50, but only up to the first $1,000. After that, the leverage is capped at 1:5.

Skilling is a regulated trading platform, which means that certain restrictions will apply. For example, those in the UK and Europe will be capped by the usual 1:30 limit – unless they are a professional client. Supported trading platforms at Skilling include MT4 and cTrader, as well as its own native browser-based interface.

FX Pairs |

74 |

Max Leverage |

Up to 1:500 |

Commission |

0% |

EUR/USD Spread |

From 0.5 pips |

Other Assets |

CFDs via stocks, indices, commodities, cryptocurrencies |

Platforms |

Web trader, mobile app, MT4, cTrader |

US Clients |

No |

Brokerage Type |

CFD |

What We Like

- Maximum leverage limit of 1:500 on major FX pairs

- 0% commissions and competitive spreads

- Multiple trading platforms to choose from

7. Forex.com – Best High Leverage Broker for US Clients

Most trading platforms that offer leverage do so via CFD instruments, which US clients cannot access for legal reasons. Forex.com, however, offers direct access to the currency markets without needing to go through CFDs.

Therefore, we found that Forex.com is one of the best US forex brokers with high leverage.

As per domestic regulations, US clients can access leverage of up to 1:50 when trading certain major currency pairs. This is inclusive of EUR/USD, USD/JPY, and USD/CAD. Other forex pairs from the minors and exotics come with lower leverage limits.

We like that Forex.com offers several account types to choose from. Casual investors might consider the standard account, which comes with 0% commission and spreads that start at 1 pip.

There is also a commission account, which attracts a fee of $5 for every $100k traded, and spreads start at 0.2 pips. The STP Pro account offers spreads as low as 0.1 pips – see our guide to the best STP brokers.

FX Pairs |

80+ |

Max Leverage |

Up to 1:50 for US clients |

Commission |

Depends on the account – from 0% commission |

EUR/USD Spread |

Depends on the account – from 0.1 pips |

Other Assets |

Gold, silver, futures, options |

Platforms |

Web trading, mobile apps, MT4, TradingView |

US Clients |

Yes |

Brokerage Type |

STP, DMA |

What We Like

- Supports more than 80 currency pairs

- Best high leverage broker for US clients

- Great educational academy for beginners

8. Interactive Brokers – Access to Interbank Currency Quotes

Interactive Brokers is another trading platform that offers leverage to US clients. This platform will appeal to currency traders that wish to access the wholesale markets via interbank currency quotes. This means that Interactive Brokers offers some of the best rates in the market.

For example, spreads on major currency pairs can be accessed from just 1/10 of a pip. Moreover, those trading less than $1 million in a 30-day period will pay a competitive commission of 0.20 basis points. The best commission available is 0.08 basis points, but this requires a minimum monthly trade volume of over $5 million.

It is able to offer leverage within US regulatory limits, which means 1:50 on major pairs and less on other currencies. We also like Interactive Brokers for its currency trading markets across futures and options. There is no minimum deposit at Interactive Brokers, but a margin requirement will come into play when trading with leverage.

FX Pairs |

100+ |

Max Leverage |

Up to 1:50 for US clients |

Commission |

Between 0.08 and 0.2 bps |

EUR/USD Spread |

From 1/10 of a pip |

Other Assets |

Stocks, futures, options, mutual funds, ETFs, and more |

Platforms |

Client portal, trader workstation, IBKR mobile, IBKR globaltrader |

US Clients |

Yes |

Brokerage Type |

ECN broker with access to interbank quotes |

What We Like

- US traders can access deep liquidity levels

- Spreads start from just 1/10th of a pip

- Access to the interbank wholesale market

9. FBS – Highest Leverage in the Market at up to 1:3000

We found that the best high leverage broker for those with an appetite for risk is FBS. The reason for this is that FBS offers leverage of up to 1:3000. This means that for every $100 staked, a trading position of up to $300,000 can be entered.

This is only available on standard and zero-spread accounts. Standard accounts require a minimum deposit of $100 and come without commission alongside spreads that start from 0.5 pips. Those opting for a zero-spread account will be able to trade from 0 pips alongside a commission of $20 per lot.

FBS also offers ECN accounts, which come with a maximum leverage limit of 1:500. This top-rated broker supports a wide selection of asset classes. This covers everything from forex, metals, indices, and energies to stocks and crypto. Trading platforms are inclusive of MT4 and MT5, as well as the native FBS web trader.

FX Pairs |

28 |

Max Leverage |

Up to 1:3000 |

Commission |

Depends on the account – from 0% |

EUR/USD Spread |

Depends on the account – from 0 pips |

Other Assets |

Metals, indices, energies, stocks, crypto |

Platforms |

FBS web trader, MT4, MT5 |

US Clients |

No |

Brokerage Type |

ECN, DMA |

What We Like

- Highest leverage in the market at 1:3000

- Access to ECN markets

- Supports lots of asset classes and financial instruments

10. HotForex – High Leverage Forex Broker With Limits of up to 1:1000

The final option to consider from our list of the best high leverage brokers is HotForex. As the name suggests, this trading platform specializes in currencies. The platform supports more than 50 pairs across majors, minors, and exotics.

There are multiple account types to choose from, so traders of all levels should find something that suits them. Absolute beginners might consider the micro account, which requires a minimum deposit of just $5 and this comes with a maximum leverage ratio of 1:1000.

This account offers spreads from 1 pip, albeit, no commissions apply. More experienced traders might consider the zero-spread account, which offers spreads from 0 pips on major forex pairs and a standard commission of $3 per lot traded. In addition to forex, this top-rated broker also offers CFDs via stocks, indices, commodities, and more.

FX Pairs |

50 |

Max Leverage |

Up to 1:1000 |

Commission |

Depends on the account – from 0% |

EUR/USD Spread |

Depends on the account – from 0 pips |

Other Assets |

CFDs via crypto, stocks, indices, commodities, and more |

Platforms |

MT4, MT5 |

US Clients |

No |

Brokerage Type |

ECN, STP |

What We Like

- Leverage limits of up to 1:1000

- Account minimums start from just $5

- One of the top forex brokers for ECN account access

Conclusion

This guide has compared the overall best high leverage brokers to consider today.

When choosing a suitable platform, it is important to focus on metrics other than just maximum leverage limits. On the contrary, the investor should explore fees, supported markets, customer service, regulation, and more.

To conclude, we found that the overall best high leverage broker is eToro. The platform not only offers tight spreads, but thousands of markets in a fully regulated trading environment.

FAQ’s

Which broker has the highest leverage?

Leverage limits often depend on the investor’s country of residence, as well as the asset being traded. Nonetheless, we found that the broker offering the highest leverage to retail clients is FBS, at up to 1:3000. However, trading with leverage limits of this magnitude is extremely risky.

Is high leverage trading safe?

The higher the leverage, the more chance there is that the position will be liquidated. If this happens, the trader will lose their original stake.