Description

ActivTrades is a UK-based broker offering forex and CFD trading plus spread betting on MT4, MT5 and its ActivTrader platform. The brand also posts average execution speeds of 0.004 seconds. Our 2022 review covers the login process, margin requirements, bonuses and more. Find out if ActivTrades is the right broker for your financial goals.

ActivTrades Overview

ActivTrades PLC was founded in 2001 in Switzerland and established its London headquarters in 2005. The broker has a strong client base in Europe across Italy, Germany, France, and Portugal as well as overseas markets, such as Australia.

The company’s number of employees runs in the hundreds and it has offices in Milan, Bahamas, Dubai, Bulgaria (Sofia) and Luxembourg. ActivTrades Corp is a subsidiary of ActivTrades PLC, authorized and regulated by the UK Financial Conduct Authority (FCA). The global brokerage also holds a license with the Securities Commission of the Bahamas.

Trading Platforms

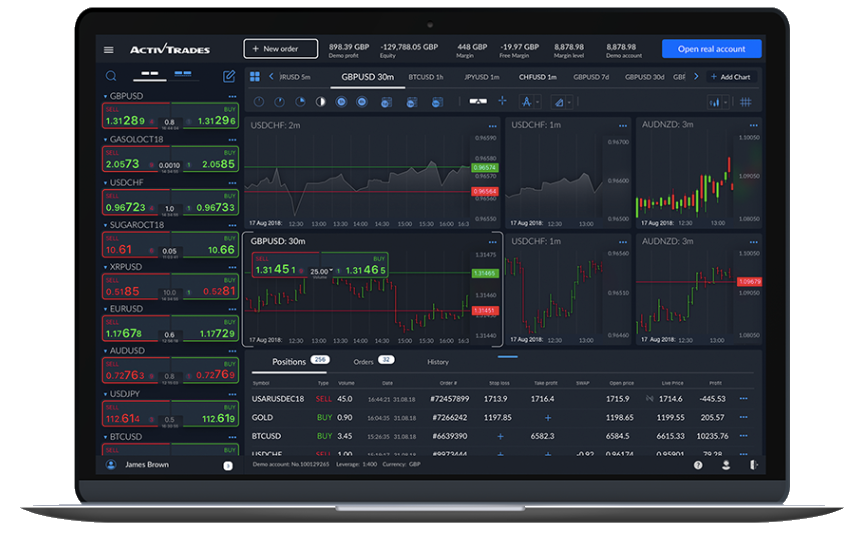

ActivTrader

ActivTrader is a user-friendly platform that combines advanced features with industry-leading technology, perfect for beginning your trading career. The platform is compatible with major web browsers, excluding Internet Explorer.

Features include:

- Market sentiment indicators

- Instant and pending order types

- Support for hedging and scalping strategies

- 14 chart types and drawing tools to help with pattern recognition

- Progressive trailing stop functionality to protect revenue and profit

Additional advanced tools, most of which are also compatible with MT4 and MT5, include:

- SmartCalculator – improves risk management by simulating different trade scenarios

- SmartPattern – automatically detects chart patterns to highlight investing opportunities

- Pivot Points Indicator – provides 3 levels of support and resistance for depicting market trends

- SmartTemplate – indicates long and short opportunities based on chart signals relative to trend strength

- SmartForecast – brings together market trend analysis and chart retracements for a simplistic view of the markets

- SmartOrder 2 – developed by ActivTrades to increase speed and improve integration between the platform and application

- SmartLines – sets pre-defined trendlines and when the price of the chosen instrument crosses the trendline, an order is placed

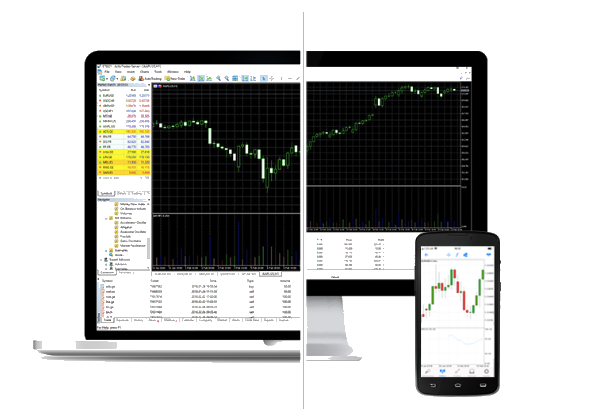

MetaTrader 4

ActivTrades offers MT4, a globally recognized platform, particularly for forex trading. You can download MT4 to desktop devices, major web browsers, and mobile.

Highlights of MT4 include:

- Price alerts

- 21 languages

- 9 time frames

- One-click trading

- Advanced frame view

- Extensive historical data

- Advanced stop-out levels

- 50 pre-installed indicators

- Automated trading through APIs

MetaTrader 5

ActivTrades also offer the MT5 platform, suited to more experienced investors. In addition to trading on forex, indices and shares, MT5 provides access to ETFs and over 500 CFDs. You can download MT5 to your desktop, use the WebTrader, or trade from your mobile.

Key benefits of the MT5 solution include:

- Historical data and strategy tester

- Price alerts and trailing stops

- Integrated trading statements

- Economic news headlines

- One-click trading

- 21 time frames

- 8 order types

Assets & Markets

Tradable assets at the online broker include:

- 1,000+ company shares, including stocks in the UK, US, German and Japanese markets

- 15+ large indices such as the Nasdaq, Dow Jones, Euronext, UK100 and Ger30

- 5 bonds – EUBBL, EUBTP, EUBUND, EUSTZ and USATB

- 16 commodity CFDs like gold, silver, energies and grains

- 16 cryptocurrencies including Bitcoin

- 50+ forex pairs such as USD/BRL

A variety of ETFs and spread betting is also provided for UK clients. Binary options are not available.

ActivTrades offers more company shares than the likes of Pepperstone and XTB. However other brokers, including eToro and Admiral Markets, offer a broader range of CFDs and cryptocurrencies.

Spreads & Commissions

ActivTrades offers competitive forex spreads as low as 0.5 pips on the EUR/USD and USD/JPY and 0.8 pips on the GBP/USD. The broker charges no commission on forex trades.

On CFDs and indices, financial spreads are as low as 0.01 pips. Shares are available at 0-0.1% commission of the transaction value, with minimums ranging between 1 USD to 5 EUR.

For UK-based clients, there is a low commission of 0.5 pips on spread betting.

The broker also charges swap rate fees for positions held overnight, further details of which can be found on the company website.

Leverage

Leverage rates are capped at 1:30 in countries that fall under ESMA regulations, including the UK. However, international traders can access up to 1:200 maximum leverage depending on lot size.

Margin ranges:

- Indices & financials: 1:5 – 1:200

- Commodities: 1:10 – 1:200

- Forex: 1:20 – 1:200

- Shares: 2% – 60%

The highest available margin for cryptocurrency is 1:10.

Note that professional accounts can unlock up to 1:400 leverage.

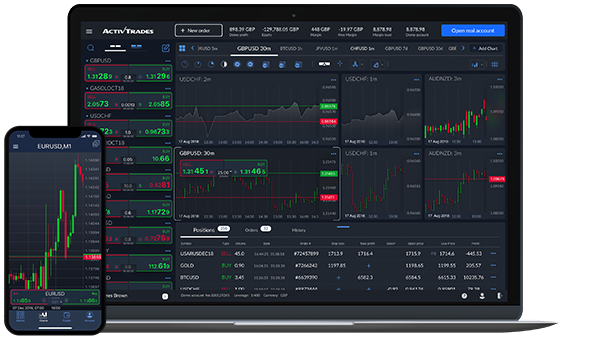

Mobile App

The ActivTrader, MT4 and MT5 platforms are all available for mobile trading. The applications allow for complete account management and price analysis from your mobile or tablet device. In addition, payments, bonuses and customer support are all available.

Head to the mobile trading section located underneath each platform page on the broker’s website for instructions on how to invest from your iPhone, iPad or Android device.

Payment Methods

Deposits

The minimum deposit at ActivTrades is fairly high at $500. Several payment methods are available offering prompt processing:

- Skrill – 30 minutes

- Neteller – 30 minutes

- Bank transfer – Same working day

- Credit/debit card (prepaid Mastercard) – 30 minutes (1.5% fee)

- Sofort – 30 minutes (only available for clients of ActivTrades PLC and ActivTrades Europe SA)

- PayPal – 30 minutes (only available for clients of ActivTrades PLC and ActivTrades Europe SA)

Withdrawals

Select ‘request a withdrawal’ from the client area to retrieve profits and revenue via the following options:

- Credit/debit card – same day if requested by 12.30 GMT

- Bank transfer – same day if requested by 12.30 GMT (£9 fee)

- Neteller – same day if requested by 12.30 GMT

- PayPal – same day if requested by 12.30 GMT

- Skrill – same day if requested by 12.30 GMT

All withdrawals are free unless transferring to Citibank or Moneycorp which incur a £9 charge.

For withdrawal problems, the customer support email address or live chat are the best forums to discuss any issues.

Demo Account

ActivTrades offers a demo account where users can test their skills with £10,000 in virtual funds. All three platforms are available in the paper trading environment. However, with the MT5 solution, market data on CFD shares are shown with a 15-minute delay.

Bonuses & Promotions

You can earn cashback on every trade you place once you reach $50m notional value traded. While a good promotion, the volume requirements in the promotional terms and conditions are high. The broker does not offer a no deposit bonus.

This offer is only available to international clients that don’t fall under ESMA laws which prohibit bonuses.

Regulation & Licensing

ActivTrades Corp is regulated by the Securities Commission of the Bahamas and is a subsidiary of ActivTrades PLC which is regulated and authorized by the Financial Conduct Authority (FCA). Under this regulation, the company must follow a pillar 1, 2 and 3 system in order to secure clients’ funds. As such, ActivTrades has a robust Internal Capital Adequacy Assessment Process (ICAAP).

The FCA is a respectable regulatory body and means the broker receives a good trust rating in this review.

Note that clients from the USA are not accepted.

Additional Features

The firm has extensive training and education courses via webinars. Free content is available at all levels from fundamental principles to advanced trading theories. The broker also offers one-to-one training with industry experts on how best to use the ActivTrades platforms and tools.

In addition, the company offers bridging loans and alternative investment options. Speak to the customer support team for more information.

Account Types

ActivTrades offers several trading account options:

- Individual

- Islamic (swap-free trading)

- Professional (for those eligible under ESMA regulations)

Both individual and professional accounts share similar features such as negative balance protection, FSCS protection, segregated accounts, and best execution. However, the standard individual account includes features such as rewards, risk alerts, and leverage warnings. It also allows for trading in mini and microlots.

Required compliance documents to open an account include passports, utility bills and bank statements.

Benefits

If you take ActivTrades vs IC Markets, NinjaTrader, ZuluTrade, or TradingView, the broker scores well in the following areas:

- Over 93.60% of orders are executed at the requested price

- ActivTrader Smart Order 2 increases investing efficiency

- Choice of platforms, including MT4 & MT5

- Negative balance protection

- 24/5 customer support

- Generous margins

- Free webinars

- VPS

Drawbacks

Downsides of trading with ActivTrades include:

- £10 monthly inactivity fee after a year of no trading

- Not available to residents in the USA and Canada

Trading Hours

ActivTrades follows standard market hours. Times vary slightly depending on the instrument but typically are open Monday to Friday. Server times on the platform may vary depending on your location. Cryptos are available between Sunday 23:00 GMT and Friday 23:00 GMT.

ActivTrades runs a reduced schedule on bank holidays in line with global financial markets. More information regarding specific changes is available on the broker’s website.

Customer Support

ActivTrades offer customer support in multiple languages, 24/5. A live chat channel, a free call back hotline, plus email support are available from the respective logos and icons on the right-hand side of the official webpage. Users can also head to the FAQ section for answers to common issues. The live chat function is particularly useful with efficient and informative agents to cover most queries.

ActivTrades have a 95% customer satisfaction rating for their support service.

Security

ActivTrades Corp has fund protection insurance up to $1 million. The broker uses secure encryption protocols to protect platforms, servers and payments. The MetaTrader platforms also offer strong user security with additional authentication options at login.

ActivTrades Verdict

ActivTrades offers a broad range of accounts and tools where users can trade forex, indices, commodities, cryptos and shares. Access to the globally recognized MT4 and MT5 platforms as well as the broker’s ActivTrader solution, means investors of all ability levels are catered for.

Accepted Countries

ActivTrades accepts traders from Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use ActivTrades from United States, Canada.